- Departmental Results Report

The Honourable Navdeep Bains, P.C., M.P.

Minister of Innovation, Science and Economic

Development

© Her Majesty the Queen in Right of Canada,

represented by the Minister of Industry,

ISSN: 2561-150X

Table of contents

Minister's message

I am pleased to report progress made on making Canada a world-leading centre for innovation and science, helping create good, well-paying jobs, and strengthening and growing the middle class.

The work of the Innovation, Science and Economic Development Portfolio includes promoting innovation and science; supporting the commercialization of more research and ideas; providing more Canadians with the skills to participate in a global and digital economy; helping small businesses grow through innovation, access to capital and trade; promoting increased tourism in Canada; and supporting scientific research and the integration of scientific considerations in our investment and policy choices.

This year, the Portfolio organizations continued their work to deliver on the Government's Budget commitment to develop an Innovation and Skills Plan. The plan's focus on people and addressing the changing nature of the economy is a focus for the Portfolio's programs.

Over the past year, the CSA has continued the development of a space strategy with clear and concrete objectives for the space sector while ensuring alignment with the Innovation and Skills Plan. The CSA will focus on using space to drive economic growth, support talent, and develop technologies while promoting science and stimulating new investment in companies to leverage the benefits of space for Canadians.

It is my pleasure to present the – Departmental Results Report for the Canadian Space Agency.

The Honourable Navdeep Bains

Minister of Innovation, Science and Economic Development

Results at a glance

| What funds were used? (– Actual Spending) |

Who was involved? (– Actual Full-Time Equivalents [FTEs]) |

|---|---|

| 388,298,278 | 614.0 |

- In order to ensure that the Government of Canada's operational needs for space-based Earth observation (EO) are continually fulfilled, the Canadian Space Agency (CSA) in – continued to deliver EO data by providing efficient and effective management of the RADARSAT-2 data allocation. The CSA also made progress with the development of the RADARSAT Constellation Mission (RCM). The assembly of the first satellite was completed in the third quarter of –, and tests for the ground infrastructure (Primary Control Facility) began as planned in the fourth quarter of –.

- In – a total of 39 Government of Canada (GoC) programs within 11 departments used CSA-enabled EO data to provide services to Canadians.

- The Maritime Monitoring and Messaging Microsatellite (M3MSat) was launched on and was fully operational in . The satellite provides Automated Identification System (AIS) data for use in research related to the optimization of this type of data, as well as for commercialisation purposes.

- To meet Canada's obligations towards the International Space Station (ISS) and to strengthen research and innovation, the CSA received approval for the extension of Canada's participation in the ISS and also received authorization to develop technology options for a potential contribution to post-ISS human missions in deep space (Moon and Mars).

- In order to maintain a robust astronaut corps that meets the needs of Canada's human spaceflight program, the CSA initiated the Astronaut Recruitment Campaign (ARC) in to select two new astronauts.

- The Integrated Science Instrument Module (ISIM), which includes the CSA's Fine Guidance Sensor / Near InfraRed Imager and Slitless Spectrograph (FGS/NIRISS), was integrated with the James Webb Space Telescope (JWST), a joint international mission involving NASA, ESA and the CSA. The new assembly underwent a series of rigorous environmental testing at NASA's Goddard Space Flight Center in . This space observatory telescope constitutes the next generation of space telescopes after Hubble..

- In -, as part of its outreach activities, the CSA used space to encourage young Canadians to take up science and technology subjects through events with Astronauts and CSA experts. The ARC was used to help Canadian youth visualize the kind of exciting careers that can be had by pursuing education in Science, Technology, Engineering and Mathematics (STEM).

- The CSA continued to support the development of the workforce of tomorrow in space science and technology (SST) domains by working with universities, industry and partners. More than 148 projects including 56 grants and contributions totalling $3.8 million in Science, Technology and Expertise Development in Academia (STEDiA); 48 contracts and 44 contributions totalling $25.4 million in the Space and Technology Development Program (STDP) were funded in –.

- During –, (last year for which data is available), 9,927 full-time equivalents (FTE) were employed in the space sector and contributed to the strategic and sustained use of space. This number is 15% higher than the expected target of 8,000 FTEs.

For more information on the department's plans, priorities and results achieved, see the "Results: what we achieved

" section of this report.

Raison d'être, mandate and role: who we are and what we do

Raison d'être

The Canadian Space Agency is committed to leading the development and application of space knowledge for the benefit of Canadians and humanity.

Mandate and role

The mandate of the Canadian Space Agency (CSA) is "to promote the peaceful use and development of space, to advance the knowledge of space through science and to ensure that space science and technology provide social and economic benefits for Canadians.

"

The CSA is delivering on its mandate in collaboration with Canadian industry, academia, Government of Canada organizations, and other international space agencies or organizations.

The founding legislation that received Royal Assent in attributed four main functions to the CSA:

- Assist the Minister to coordinate the space policies and programs of the Government of Canada;

- Plan, direct, manage and implement programs and projects relating to scientific or industrial space research and development and the application of space technology;

- Promote the transfer and diffusion of space technology to and throughout Canadian industry; and

- Encourage commercial exploitation of space capabilities, technology, facilities and systems.

For more general information about the department, see the "Supplementary information

" section of this report. For more information on the department's organizational mandate letter commitments, see the Minister's mandate letter.

Operating context and key risks

Operating context

Canada's space sector is made up of a wide range of participants who rely on the development and use of space assets, capabilities, and space data. These interdependent groups are drawn from across government, industry and academia, and perform key functions in the space ecosystem. The Canadian space sector also exists against a dynamic backdrop of new uses for efficient space-based services, enhanced commercial opportunities, and expanded international collaborations in an increasingly globally competitive environment.

New Applications, Players, and Commercial Opportunities

Governments at all levels, scientific communities and industries leverage space-based data to deliver on their mandates and pursue their objectives, whether commercial or scientific. Space provides a unique vantage point with an unobstructed view of Canada and the world to gather information essential to daily operations, monitoring and protecting our territory. Space-based data and services help provide crucial evidence-based information on which the government makes decisions and also supports critical government operations, such as search and rescue operations or pollutant tracking to safeguard the environment, health, safety and security of all Canadians.

Globally we see the space sector evolving as technological advances make space more accessible to a broader range of players. This trend is driven by the miniaturization of various space technologies and the deployment of smaller satellites and satellite constellations which is driving down costs. This is accompanied by an increased potential in the availability of commercial applications. As a result, space business is being transformed through more opportunities and competitiveness. On the one hand, there are new opportunities for Canadian companies and researchers as well as new partnership opportunities between governments, industry and academia. On the other hand, Canada risks losing ground as other countries seek to benefit from the potential of space given that the number of countries investing in their own space programs has increased significantly in the last few years. Since the total number of countries with a space program has more than doubled, growing from 37 countries in to 80 in .

In an effort to better tackle these new challenges and opportunities, the CSA is working with government stakeholders on a space strategy that will focus on using space to drive broader economic growth, support talent, and develop technologies while promoting science and stimulating new investment in companies to leverage the benefits of space for Canadians.

The International Agenda

In delivering its mandate, the CSA works in partnership with other spacefaring nations using innovative and affordable technologies to tackle some of the most pressing global issues such as climate change.

The CSA also made directed investments in key technologies and flight opportunities that support innovation in an effort to ensure that the Canadian space sector remains relevant in a dynamic international context. To ensure alignment between the CSA's initiatives and the missions planned by partner agencies or pursued by the commercial space sector globally, the CSA continues to work through international collaborations and international committees such as the International Space Exploration Coordination Group and the Committee on Earth Observation Satellites. The CSA also works closely with the National Aeronautics and Space Administration (NASA) and builds on its unique partnership with the European Space Agency (ESA) to leverage space investments as well as to maintain open access to European markets for Canadian space companies and academia.

Key risks

In a rapidly evolving context, with diverse needs and long-term timeframes to develop assets, gaps between the services provided, and the services needed, can be an issue. Consultations held as part of the development of a space strategy will help to set a long-term vision with clear and concrete objectives for the future and enable the identification of options for reducing the risks of gaps between the services provided and the services needed in future.

With regard to Earth observation data continuity specifically, the CSA is closely monitoring the implementation phase of the RADARSAT Constellation Mission (RCM), the successor of RADARSAT-2. Options involving alternate sources of data have been initiated in the event of a data gap from a RADARSAT-2 failure prior to the RCM being launched in or a delay in RCM.

In –, growth of the Canadian space sector continued to represent a challenge in terms of its ability to market products and services worldwide. Canada's space sector, especially small and medium enterprises, remained reliant on continued research and development investments to increase existing growth opportunities and seek new ones. This year, the CSA offered a more responsive and consolidated new approach to the STDP following consultations with key players in industry and academia in fall . Starting in , this new approach was implemented for new STDP investments to better target the needs of the partners. This will help reduce the lag between idea generation and implementation by providing activities from pre-mission R&D to timely flight demonstration aimed at increasing space and market readiness. The CSA also reinforced consultation structures to develop a coordinated innovation roadmap that reduces the risk of missed opportunities related to international space projects and ensures identified priorities align with future national needs.

The CSA also continued to advance space robotics, optics, satellite communications, space-based radar and other key technologies, in order to maintain Canada's current competitive edge.

Unexpected technical challenges associated with the development of space missions represented another source of risk for the CSA in –. The technical challenges in complex international components of some projects could have led to schedule slippages and increased costs. In order to mitigate this risk, the CSA continued to strengthen its project management capacity. Among the activities conducted in –, the Project Management Framework was streamlined for efficiency, several events were held by the community of practice in project management, and more frequent (monthly) project status were presented to the senior management committee. These activities enhanced the management and control processes already in place.

It should also be noted that in –, the CSA updated its Investment Plan (IP), which will contribute to further mitigation of the risk related to the management of financial resources. The IP provides a concrete, integrated and comprehensive portrayal of our investment whilst highlighting our new governance structure, including the new Investment Governance and Monitoring Framework (IGMF).

| Risks | Mitigating strategy and effectiveness |

Link to the department's Programs | Link to mandate letter commitments or to government-wide and departmental priorities |

|---|---|---|---|

| Space sector capacity Canada's space sector capacity may be at risk in the face of the arrival of new players, uncertain investment levels and potential technology development issues. A decrease in this capacity could make it insufficient to meet Canada's future requirements, including necessary partnerships for maintaining Canada's position in the space exploration field. |

All measures contributed to maintaining the risk at an acceptable level, while the development of the space strategy is expected to contribute to further reducing risks in the future. |

|

|

| Gap between stakeholders' expectations and the CSA's provision of products and services Because of possible interruption of missions in progress, insufficiency of infrastructure or personnel in place, delays in project implementation or changes in stakeholders' requirements and priorities, there is a risk of a gap between the partners' expectations and the data and services provided by the CSA; this may affect the achievement of expected outcomes. |

All measures contributed to maintaining the risk at an acceptable level, while the development of the space strategy is expected to contribute to further reducing risks in the future. |

|

|

| Unexpected technological challenges Unexpected technological challenges and changing requirements induced by the development of technologies in partnerships may lead to scheduling issues or cost increases. |

|

|

|

| Financial resource management Because of increases in project cost, a higher share of funding allocated to operations, there is a risk that the funds available for new initiatives may be insufficient or that the choice of investments may be inappropriate. This may mean that existing infrastructure or R&D investments may not be able to meet Canada's future space requirements. |

|

|

|

Results: what we have achieved

Program 1.1: Space Data, Information and Services

Description

This Program includes the provision of space-based solutions (data, information and services) and the progression of their utilization. It also serves to install and run ground infrastructure that processes the data and operates satellites. This Program utilizes space-based solutions to assist Government of Canada (GoC) organizations in delivering growing, diversified or cost-effective programs and services within their mandate, which is related to key national priorities, such as sovereignty, defence, safety and security, resource management, environmental monitoring and the North. It also provides academia with data required to perform its own research.

The services delivered through this Program are rendered, and the data and information are generated and processed, with the participation of the Canadian space industry, academia, GoC organizations, national and international organizations, such as: foreign space agencies, not-for-profit organizations, as well as provincial and municipal governments. This collaborative effort is formalized under national and international partnership agreements and contracts. This Program is also funded through the Class Grant and Contribution Program.

Results

The CSA's activities encompass concept and feasibility studies, space missions and programs, and applications development, all necessary to the delivery of useful space-based information to support sound, evidence-based decision making and efficient government services, leading to economic and social benefits for all of society.

In – the CSA continued to deliver Earth observation (EO) data by providing efficient and effective management of the RADARSAT-2 data allocation to GoC. The CSA also supported opportunities for the effective use and reuse of archived RADARSAT-1 imagery. In – 533 archived images were delivered to GoC and other customers.

The CSA made progress with the RADARSAT Constellation Mission (RCM). The assembly of the first satellite was completed in the third quarter of – and tests for the ground infrastructure (Primary Control Facility) began as planned in the fourth quarter of –. The objective of the RCM is to ensure data continuity, improve operational use of Synthetic Aperture Radar (SAR) and improve system reliability. The three-satellite configuration of RCM will provide multiple daily captures of Canada's vast territory and vessel traffic near our borders as well as daily access to 90% of the world's surface. The RCM will also include an Automatic Identification System (AIS) payload, improving Canada's space-based capabilities to detect ships and manage marine traffic. The SAR and related AIS data policies, which will provide frameworks for the utilization of these capacities, were presented to the interdepartmental governance committee in the third quarter. Departments agreed to initiate consultations with non-government stakeholders on the intents of the SAR Data Policy, resulting in a webinar held in with the downstream sector. Based on comments received, follow-up meetings were scheduled and held with stakeholders on an individual basis.

The Maritime Monitoring and Messaging Microsatellite (M3MSat) was launched on , and was fully operational in . The satellite provides AIS data for use in research related to the optimization of this type of data, as well as for commercialization purposes.

Agreements were signed by Natural Resources Canada (NRCan), Environment and Climate Change Canada (ECCC) and Agriculture and Agri-Food Canada (AAFC) regarding five new projects to develop innovative applications aiming to improve climate change and ecosystem monitoring, as well as crop characterization. The CSA is investing $4.5 million for the next three years, representing 40% of the projects' budgets.

The CSA supported capacity development of value-added products and services in the space industry by continuing to fund 17 ongoing R&D projects, 11 projects for Environmental Remediation and six projects in collaboration with Germany's Aerospace Center (DLR) to test the interoperability of both the Canadian and German systems. The CSA also initiated seven concept studies for combining data acquired using drones with satellite data, ten projects on disaster management and six studies to improve the monitoring of vessels using AIS data.

As a result of ongoing efforts, an additional new government program, the Ecosystem and Environmental Assessments and Monitoring from Environment and Climate Change Canada (ECCC), benefitted from the operational use of EO. In – a total of 39 GoC programs within 11 departments used CSA-enabled EO data to provide services to Canadians.

With the view of offering future capacity to support GoC in the delivery of its mandate, the CSA continued its participation in the development of an infrastructure to support the management of the Earth's water resource with the Surface Water and Ocean Topography (SWOT), an international mission involving NASA, ESA and the CSA, to be launched in . The CSA's contribution, a key component of the radar instrument, secures privileged access for Canadian scientists to the SWOT data. In –, the CSA awarded the contract for the key component of SWOT radar. Canada's participation in this mission brings significant benefits for the strength and expertise of our industry and its economic growth, and an important gain in scientific knowledge, in collaboration with ECCC and Fisheries and Oceans Canada.

The CSA continued to provide support to Canadian science teams in the area of Sun-Earth System Science. Support for operating and producing data with Canada's OSIRIS instrument on Sweden's Odin satellite, launched in , was extended until . Canadian scientists will continue to analyze the resulting datasets that have historical value and play an important role in international efforts regarding climate change, including ESA's Climate Change Initiative, the Intergovernmental Panel on Climate Change and the World Meteorological Organization ozone reports.

The CSA was requested to provide satellite imagery in response to 29 of the 40 disaster events which triggered an activation of the International Charter on Space and Major Disasters during fiscal year –. The CSA delivered RADARSAT-2 images (54 archived images and 69 new acquisitions) to affected countries, helping to mitigate the effects of disasters on human life and property.

Finally, support for operating and producing data with Canada's Measurement of Pollution in the Troposphere (MOPITT) instrument on NASA's Terra satellite was extended until . Canadian scientists use the information on the biosphere, atmosphere, and oceans to forecast the long-term effects of pollution, to understand the increase in ozone concentrations in the lower atmosphere and to orient the assessment and implementation of short-term pollution controls.

The – variance of $44.5 million between Planned Spending and Actual Spending is mainly due to variations in the payment schedules in the implementation cycle for RCM, which are an inherent implementation characteristic of the Canadian Space Program.

| Expected result | Performance Indicator | Target | Date to achieve target | – Actual Result | – Actual Result |

– Actual Result |

|---|---|---|---|---|---|---|

| 1. GoC organizations offer more diversified or cost- effective programs and services due to their utilization of space-based solutions. | 1. Number of new GoCs programs offering more diversified or efficient services. | 1 | 1 | 1 | 36Footnote 1 |

| – Main Estimates |

– Planned spending |

– Total authorities available for use |

– Actual spending (authorities used) |

– Difference (actual minus planned) |

|---|---|---|---|---|

| 215,086,172 | 215,086,172 | 229,894,207 | 170,632,929 | (44,453,243) |

| – Planned |

– Actual |

– Difference (actual minus planned) |

|---|---|---|

| 103.1 | 104.6 | 1.5 |

Supporting information on results, financial and human resources relating to the Canadian Space Agency's lower-level programs is available on TBS InfoBase.

Program 1.2: Space Exploration

Description

This Program provides valuable Canadian science, signature technologies and qualified astronauts to international space exploration endeavors. This Program contributes to the Government of Canada's Science and Technology Strategy. It fosters the generation of knowledge as well as technological spinoffs that contribute to a higher quality of life for Canadians. It generates excitement within the population in general and contributes to nation-building. This Program appeals to the science and technology communities. It is targeted mostly towards Canadian academia and international space exploration partnerships. Canadian industry also benefits from the work generated within this Program.

This Program is delivered with the participation of foreign space agencies and Government of Canada (GoC) organizations. This collaborative effort is formalized under international partnership agreements, contracts, grants or contributions.

Results

Through a workshop held in and interactions with CSA consultative committees, including the Joint Committee on Space Astronomy (JCSA); the Planetary Exploration Consultation Committee (PECC); the Health and Life Science Consultation Committee (HLSCC); Space Technology Consultation Committee (STCC); and the Joint Space Exploration Consultation Committee (JSECC), the CSA consulted Canadian industry, academia and international partners and collected information in order to optimize Canada's presence on the International Space Station (ISS) and to identify potential space exploration opportunities that will generate world-class science, innovation and talent. In , the CSA received approval for the extension of Canada's participation in the ISS and also received authorization to develop technology options for a potential contribution to post-ISS human missions in deep space (Moon and Mars). Discussions with other space agencies took place throughout the year which enabled the CSA to identify specific technologies and begin initial procurement activities including soliciting proposals from Canadian industry and academia.

Canada's space exploration program has achieved success through Canadian scientists' contributions to space life sciences, space astronomy and planetary missions. Over the last fiscal year, Canadian researchers have added to the body of scientific knowledge. A total of 196 peer-reviewed scientific publications were produced. This represents a decrease from the average of 287 publications over the last four years (– to –). The decrease in publications is directly related to a shift in space projects being funded currently by the CSA. Significant investments have been made in the James Webb Space Telescope and given it has not been launched yet, no publications have occurred to date resulting in the drop compared to previous years.

The CSA's space missions have resulted in the transfer of technologies and knowledge to benefit Canadians. For example, the knowledge acquired from the Canadarm2 was used in – for the development of Image-Guided Automated Robot (IGAR), a robotic platform enabling minimally invasive surgical procedures for the treatment of various medical conditions. In , a Montreal-based company, GHGSat, launched a commercial satellite that uses the operational planning software developed under the CSA's Space Exploration program to track greenhouse gases from space.

In order to meet the ISS flight requirements, the CSA maintained Canada's human space flight expertise by having our two Canadian astronauts certified for long-duration flight assignments. In , David Saint-Jacques officially began his mission training for his flight to the ISS.

In order to maintain a robust astronaut corps that meets the needs of Canada's human spaceflight program, the CSA initiated a recruitment campaign in to select two new astronauts. For the recruitment campaign, the impact of Gender-Based Analysis Plus led to close monitoring and data collection of various gender and identity factors of candidates. Adapted physical performance criteria were carefully developed by the CSA and the Department of National Defence (DND).

Canada's obligations to the ISS were met via the sustained and successful operations of the Mobile Servicing System (composed of Canadarm2, the Mobile Base and Dextre). The CSA was able to address several ISS hardware anomalies and keep the Servicing System fully operational while remaining within its approved budget. The CSA continued to provide technologies and services to the ISS as part of its commitment to the partnership until . Other examples of work completed this year include:

- The conceptual design of the Dextre Deployable Vision System (DDVS) was completed and work has begun in industry on the design and build phase. The DDVS will be deployed on the ISS in order to perform inspections of the external surfaces of the ISS and help dock visiting vehicles.

- The CSA successfully completed the Preliminary and Critical Design Review of the Mobile Servicing System replacement cameras (MSS RCAM). The build phase of the project will begin in –.

- The CSA captured, manoeuvred and released with the Canadarm2 five U.S. commercial vehicles (SPX-8, SPX-9, Orbital 5, Orbital 6 and SPX-10) and one Japanese (HTV-6) cargo vehicle.

- The Space Exploration Program focuses on health research with potential results in Canadian population health, especially for aging and isolated populations, that can influence delivery of clinical healthcare activities for all Canadians. Throughout the year, four health studies have collected data on the ISS to better understand the health risks associated with spaceflight such as the effect of inactivity and psychosocial adaptation to extreme isolation.

- The Space Exploration Program also supported the development of a new technology, the Life Science Research System (LSRS). It is composed of two bio-diagnostic technological instruments that will perform real-time and on-orbit analysis of biological samples (e.g. blood, urine) and of astronaut's physiological parameters (e.g. heart rate, blood pressure). The preliminary design of the instruments was completed in –.

The Integrated Science Instrument Module (ISIM), which includes the CSA's Fine Guidance Sensor / Near InfraRed Imager and Slitless Spectrograph (FGS/NIRISS), was integrated with the James Webb Space Telescope (JWST), a joint international mission involving NASA, ESA and the CSA. The new assembly underwent a series of rigorous environmental testing at NASA's Goddard Space Flight Center in . This space observatory telescope constitutes the next generation of space telescopes after Hubble.

Canada is a partner in two planetary exploration missions:

- The Curiosity Mars rover, which has been operational on the surface of Mars since and to which Canada has contributed the Alpha-Particle X-Ray Spectrometer. The APXS instrument is used on a regular basis and has cumulated over 2,300 hours of operation so far.

- The OSIRIS-REx (Origins, Spectral Interpretation, Resource Identification, and Security-Regolith EXplorer) asteroid sample return mission, which was successfully launched on , is on its way to asteroid Bennu carrying a Canadian laser altimeter that will be used for mapping. The Canadian instrument was successfully turned on after launch and is expected to be used in the fall of .

Finally, the CSA also conducted a study to assess the feasibility and cost of NASA's Wide Field InfraRed Survey Telescope (WFIRST) mission, which was recommended by the National Academy of Sciences as the top priority for space astrophysics after the James Webb Space Telescope (JWST) in the latest decadal plan published in .

The variances of $7.1 million in the budgetary financial resources table on the next page and 9.5 FTEs in the Human Resources table on the next page are mainly due to internal reallocations of $2.4 million between Space Exploration Sub-sub-programs (SSP) 1.2.2.3 and 1.2.3.3 and the Sub-program (SP) Space Technology Development 1.3.2 in order to improve efficiency and program results. Another $1.8 million is attributable to savings following the development of a collaborative agreement with the Department of National Defence regarding the astronaut recruitment campaign.

| Expected results | Performance Indicators | Target | Date to achieve target | – Actual Result | – Actual Result |

– Actual Result |

|---|---|---|---|---|---|---|

| 1. Expansion of advanced scientific knowledge acquired through space exploration endeavours. | 1. Number of peer-reviewed scientific publications, reports and conference proceedings using space exploration information and produced by researchers (sciences and technology) in Canada. | 200 | 196 | 299 | 362 | |

| 2. Multiple use and applications of knowledge and know-how acquired through space exploration endeavours. | 1. Number of terrestrial applications of knowledge and know-how acquired through space exploration endeavours. | 1 | 1 | 7 | 2 | |

| 2. Number of space re-utilizations of knowledge and know-how acquired through space exploration endeavours. | 1 | 1 | 1 | 2 |

| – Main Estimates |

– Planned spending |

– Total authorities available for use |

– Actual spending (authorities used) |

– Difference (actual minus planned) |

|---|---|---|---|---|

| 99,437,361 | 99,437,361 | 101,727,757 | 92,310,988 | (7,126,373) |

| – Planned |

– Actual |

– Difference (actual minus planned) |

|---|---|---|

| 160.6 | 151.1 | (9.5) |

Supporting information on results, financial and human resources relating to the Canadian Space Agency's lower-level programs is available on TBS InfoBase.

Program 1.3: Future Canadian Space Capacity

Description

This Program attracts, sustains and enhances the nation's critical mass of Canadian space specialists, fosters Canadian space innovation and know-how, and preserves the nation's space-related facilities capability. In doing so, it encourages private-public collaboration that requires a concerted approach to future space missions. This Program secures the nation's strategic and ongoing presence in space in the future and preserves Canada's capability to deliver internationally renowned space assets for future generations. It is targeted at Canadian academia, industry and youth, as well as users of Canadian space solutions (Government of Canada [GoC] organizations) and international partners.

This Program is conducted with the participation of funding agencies, GoC organizations along with government facilities and infrastructure, foreign space agencies, not-for-profit organizations and provincial governments. This collaborative effort is formalized under contracts, grants, contributions or national and international partnership agreements.

Results

In consultation with partners and stakeholders in the government, industry and academia, the CSA continued to foster a strong Canadian space sector that supports an innovative and knowledge-based economy. In –, the CSA provided through its Space and Technology Development Program (STDP) funds totalling $25.4 million and partnership opportunities to industry and academia. The CSA also offered a more responsive and consolidated new approach to the STDP following consultations with key players in industry and academia in fall . Starting in , this new approach was implemented for new STDP investments to better target the needs of the partners. The approach includes letting the space community know months in advance of upcoming Requests for Proposals (RFPs) as well as Announcements of Opportunity (AOs), informing them of topics and themes for better preparation.

The monetary value of Canadian space sector R&D investments amounted to $256 million in – (which is the latest year of data available), $96 million (60%) higher than the target of $160 million. In –, the target was increased from $60 million to $160 million to reflect a change in the methodology. Prior to the methodology change, the CSA was only collecting information on R&D funded by the government (externally funded). Since the methodology change, the CSA collects information on R&D funded by both the government (externally funded) and companies (internally funded).

The CSA invested an additional $30 million in the ESA's satellite communications technology development program following ESA's Ministerial Council in . Total investments for this initiative have been approved at more than $80 million. The CSA also cooperated with ESA to open the European market to Canadian industry in order to make the space sector more productive and export-oriented.

In –, the CSA also engaged the Canadian space sector in order to optimize the David Florida Laboratory's (DFL's) support and ensure complementarity of assembly, testing and integration facilities for Canadian industry and universities. The DFL has provided throughout the year cost-recoverable services to clients totalling $1.6M, especially for the CSA's RCM project. In order to maintain the DFL as a state-of-the-art facility, several projects are in different phases of completion, including upgrades to the Thermal Vacuum Chamber 3, the Controller and Data Acquisition Frontend, the Thermal Response and Power System (TRAPS) and the Combined Data Acquisition and Control System (CDACS). The anechoic chamber refurbishing, which was funded in Budget , is in progress and will be completed in –.

The CSA supported capability demonstration opportunities with the Canadian space sector in order to raise its space readiness in science and technology. In –, the CSA:

- Delivered pre-space capability demonstration through projects and initiatives in various areas including: rover deployment (MSRAD – Mars Sample Return Analogue Deployment in Utah), stratospheric balloons (STRATOS campaign in Kiruna, Sweden, and campaign Adelaide, Australia, following the initial plan), and pre-space demonstrations (CATS – Canadian Atmospheric Tomography System, SHOW ER2 – Spatial Heterodyne Observations of Water instrument).

In –, the CSA continued to support the development of the workforce of tomorrow in space science and technology (SST) domains by working with universities, industry and partners. More than 148 projects including 56 grants and contributions totalling $3.8 million in Science, Technology and Expertise Development in Academia (STEDiA); 48 contracts and 44 contributions totalling $25.4 million in the Space and Technology Development Program (STDP) were funded in –.

During – (which is the latest year of data available), 9,927 full-time equivalents (FTE) were employed in the space sector and contributed to the strategic and sustained use of space. This number is 15% higher than the expected target of 8,000 FTEs. Of these, more than 4,264 highly qualified personnel (HQPs) have strengthened the critical mass of Canadas's space specialists to stimulate space innovation and expertise. This result is 22% higher (764 HQPs) than the expected target of 3,500 HQP.

The variance of $12.9 million in the budgetary financial resources table is mainly attributable to:

- A $7.6 million increase in payments under the cooperation agreement with ESA following the implementation of Budget . Budget allocated $30 million over four years, starting in –, to ESA in order to ensure continued Canadian participation in ESA's Advanced Research in Telecommunications Systems program;

- $5.8 million additional funds allocated to the STDP following the amendment of contracts previously awarded; and

- $1.1 million of expenditures for qualification services performed on the RCM project, as well as contracts related to the maintenance of test equipment.

The variance of 14.3 FTEs is mainly due to an internal reallocation of activities and resources from the Space Exploration program and the allocation of additional resources for the delivery of new capability demonstration opportunities as well as additional innovation planning efforts required for building the future space capacity of the Canadian space sector.

| Expected result | Performance Indicator | Target | Date to achieve target | – Actual Result | – Actual Result |

– Actual Result |

|---|---|---|---|---|---|---|

| 1. Canada holds a space community (academia, industry and government) able to contribute to the sustained and strategic Canadian use of space. | 1. Number of FTE/HQP in the Canadian space sector. | 8,000 FTEFootnote 2 | 9,927 FTE | 4,226 HQPFootnote 2 | 4,360 HQPFootnote 2 | |

| 2. Monetary value of the Canadian space sector R&D investments. | $160 million | $256 million | $146 million | $180 million |

| – Main Estimates |

– Planned spending |

– Total authorities available for use |

– Actual spending (authorities used) |

– Difference (actual minus planned) |

|---|---|---|---|---|

| 66,094,200 | 66,094,200 | 76,015,457 | 79,004,716 | 12,910,516 |

| – Planned |

– Actual |

– Difference (actual minus planned) |

|---|---|---|

| 91.6 | 105.9 | 14.3 |

Supporting information on results, financial and human resources relating to the Canadian Space Agency's lower-level programs is available on TBS InfoBase.

Internal Services

Description

Internal Services are those groups of related activities and resources that the federal government considers to be services in support of programs and/or required to meet corporate obligations of an organization. Internal Services refers to the activities and resources of the 10 distinct service categories that support Program delivery in the organization, regardless of the Internal Services delivery model in a department. The 10 service categories are: Management and Oversight Services; Communications Services; Legal Services; Human Resources Management Services; Financial Management Services; Information Management Services; Information Technology Services; Real Property Services; Materiel Services; and Acquisition Services.

Results

The CSA continues to advance the development of a space strategy to set a long-term vision with clear and concrete objectives for the space sector and to align the CSA's efforts with the Innovation and Skills Plan. The strategy will focus on using space to drive economic growth, support talent, and develop technologies while promoting science and stimulating new investment in companies to leverage the benefits of space for Canadians. The Minister of ISED's newly reconstituted Space Advisory Board will provide advice to the Minister on the future direction of Canada's space program through consultations with Canadians.

The CSA also updated its five-year Investment Plan (IP). The IP identifies key investments in asset acquisitions, acquired services and projects that demonstrate how Agency investments are aligned with government objectives and Agency's priorities. It also outlines the Agency's governance processes associated with planning, prioritization and investment decision making.

With the release of a new Policy on Results, the CSA worked to improve its project management and reporting framework to measure tangible outcomes resulting from its work and translate them into quantifiable benefits that can be effectively communicated to Canadians. The CSA recognizes that it is of the utmost importance to be in a position to regularly provide simple yet powerful reports on how resources are being used to fulfill the Agency's commitments.

The CSA continued to implement its people-effective management strategy, an integrated three-year strategy that focuses on improving working conditions, ensuring healthy and empowering work environments, establishing a productive and skilled workforce and delivering internal services that are modern, efficient and relevant to clients as planned.

The CSA has implemented two three-year strategies, one for the Information Management (IM) section and another for the Information Technology (IT) section, both including the new governmental initiatives. The most important new IM/IT initiative was the establishment of the Open Government initiative. In this direction, the objectives of making a CSA datasets inventory and publishing it on the Open Government portal were achieved.

All accelerated infrastructure upgrades and repairs at the DFL progressed in – and are scheduled to be completed in –. This will maintain the DFL as a state-of-the-art facility for assembly, integration and testing (AIT) of spacecraft and space components, and to ensure compliance with applicable building codes and standards.

Implementation of two important security infrastructure improvements at the John H. Chapman Space Centre began in –. A contract was issued in to replace and modernize the facility's security systems with state-of-the-art technologies and the plans and specifications were finalized early to publish the call for tenders for building a new perimeter and access control infrastructure. Both projects are to be completed in –. Along with the delivery of core security services, security awareness activities have been held and mandatory security-related training for all employees has continued being given. These initiatives are key to mitigating certain corporate security risks and raising general awareness among employees.

The variance of $5.4 million is mainly attributable to the re-profiling of funds in order to meet revised schedule of real-property projects such as John-H. Chapman Space Center roof refurbishment and DFL infrastructure refit.

In -, the difference of 11.3 between actual and planned FTEs is mainly due to delays in staffing activities, corporate staffing action plan is underway in order to fill the positions.

| – Main Estimates |

– Planned spending |

– Total authorities available for use |

– Actual spending (authorities used) |

– Difference (actual minus planned) |

|---|---|---|---|---|

| 51,777,088 | 51,777,088 | 51,711,225 | 46,349,645 | (5,427,443) |

| – Planned |

– Actual |

– Difference (actual minus planned) |

|---|---|---|

| 263.7 | 252.4 | (11.3) |

Analysis of trends in spending and human resources

Actual Expenditures

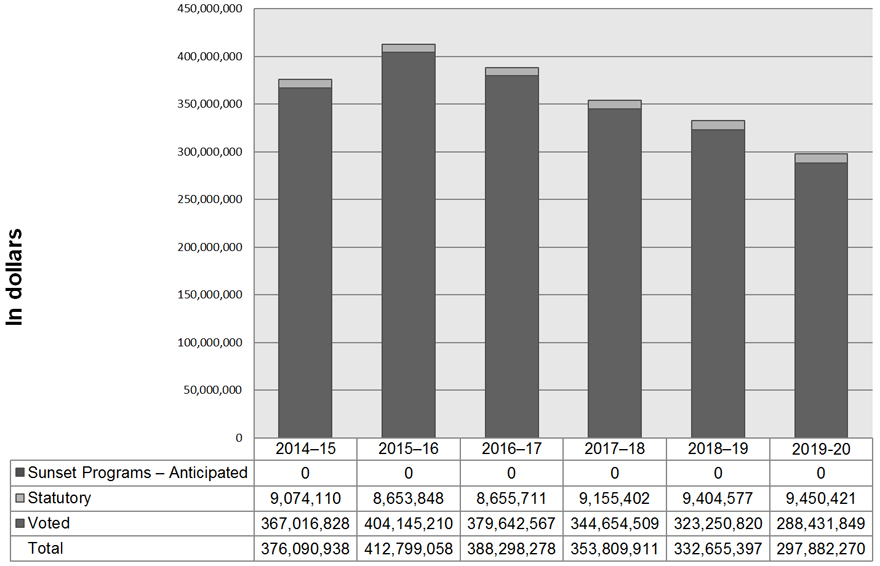

Departmental spending trend graph

Departmental spending trend graph - Text version

| - | - | - | - | - | - | |

|---|---|---|---|---|---|---|

| Sunset Programs - Anticipated | 0 | 0 | 0 | 0 | 0 | 0 |

| Statutory | 9,074,110 | 8,653,848 | 8,655,711 | 9,155,402 | 9,404,577 | 9,450,421 |

| Voted | 367,016,828 | 404,145,210 | 379,642,567 | 344,654,509 | 323,250,820 | 288,431,849 |

| Total | 376,090,938 | 412,799,058 | 388,298,278 | 353,809,911 | 332,655,397 | 297,882,270 |

The difference in the spending trend shown above is mainly attributable to the following factors:

- Budget allocated $397 million to the CSA over five years beginning in – to develop the RADARSAT Constellation Mission (RCM). Of the additional $374.2 million over six years beginning in – allocated for RCM, $140.0 million was new funding and $234.2 million was transferred from other government departments to the CSA;

- The CSA's contribution to the Budget Strategic Operating Review was $24.7 million in – and ongoing $29.5 million starting in –;

- Additional funding and expenditure authority of $12.0 million was authorized during – for two years in order to provide enhanced space-based Automatic Identification System (AIS) data services;

- Additional funding and expenditure authority of $7.9 million over two years beginning in – was authorized for the Maritime Monitoring and Messaging Microsatellite (M3MSat) project due to the increased cost of the launch provider and associated launch delay;

- Additional funding of $9.9 million over two years beginning in – was authorized to perform accelerated infrastructure upgrades and repairs at the DFL in line with the Economic Action Plan Federal – Infrastructure announcements;

- Additional funding of $9.5 million through the re-profiling of funds to – was authorized for the provision of value-added satellite reports/images for humanitarian needs;

- In line with Budget and Budget announcements, additional funding of $30 million over four years starting in – was received for Canada's continued participation in ESA's Advanced Research in Telecommunications Systems program; and,

- Additional funding of $7.5 million received in – for Budget items related to safety increase at John H. Chapman Space Centre as well as the purchase and installation of absorber material for the DFL Bay 2 Anechoic Chamber.

| Program(s) and Internal Services | – Main Estimates |

– Planned Spending |

– Planned Spending |

– Planned Spending |

– Total Authorities Available for Use |

– Actual Spending (authorities used) |

– Actual Spending (authorities used) |

– Actual Spending (authorities used) |

|---|---|---|---|---|---|---|---|---|

| Space Data, Information and Services | 215,086,172 | 215,086,172 | 115,240,643 | 120,578,228 | 229,894,207 | 170,632,929 | 209,187,061 | 175,496,334 |

| Space Exploration | 99,437,361 | 99,437,361 | 96,455,420 | 88,855,640 | 101,727,757 | 92,310,988 | 96,419,798 | 97,329,795 |

| Future Canadian Space Capacity | 66,094,200 | 66,094,200 | 87,170,086 | 75,973,949 | 76,015,457 | 79,004,716 | 61,804,033 | 58,018,955 |

| Subtotal | 380,617,733 | 380,617,733 | 298,866,149 | 286,407,817 | 407,637,421 | 341,948,633 | 367,410,892 | 330,845,084 |

| Internal Services Subtotal | 51,777,088 | 51,777,088 | 54,943,762 | 47,247,580 | 51,711,225 | 46,349,645 | 45,388,166 | 45,245,854 |

| Total | 432,394,821 | 432,394,821 | 353,809,911 | 332,655,397 | 459,348,646 | 388,298,278 | 412,799,058 | 376,090,938 |

The changes in expenditures since – are mainly due to the following:

- Budget allocated $397 million to the CSA over five years beginning in – to develop the RADARSAT Constellation Mission (RCM) under the Space Data, Information and Services Program;

- Of the additional $374.2 million over six years beginning in – allocated for RCM, $140.0 million was new funding and $234.2 million was transferred from other government departments to the CSA; and

- The – variance of $44.1 million between Planned Spending and Actual Spending is mainly due to variations in the payment schedules in the implementation cycle for various activities, which are an inherent implementation characteristic of the Canadian Space Program.

Actual human resources

| Programs and Internal Services | – Actual |

– Actual |

– Forecast |

– Actual |

– Planned |

– Planned |

|---|---|---|---|---|---|---|

| Space Data, Information and services | 103.8 | 102.6 | 104.1 | 104.6 | 114.6 | 111.0 |

| Space Exploration | 164.4 | 154.8 | 150.0 | 151.1 | 152.7 | 148.1 |

| Future Canadian Space Capacity | 89.5 | 87.2 | 105.1 | 105.9 | 103.4 | 108.2 |

| Subtotal | 357.7 | 344.6 | 359.2 | 361.6 | 370.7 | 367.3 |

| Internal Services Subtotal | 235.2 | 246.8 | 246.0 | 252.4 | 263.9 | 267.3 |

| Total | 592.9 | 591.4 | 605.2 | 614.0 | 634.6 | 634.6 |

The progressive increase in the number of FTEs starting in – is mainly related to the following items:

- Additional government-furnished personnel over the next five years as per contractual obligation of the RCM Project in order to prepare for the transition to the operations phase; and

- Additional personnel requirements to address some gaps and priorities, which include an increased investment in students in line with attracting the new generation of public servants.

Expenditures by vote

For information on the Canadian Space Agency's organizational voted and statuary expenditures, consult the Public Accounts of Canada .

Alignment of spending with the whole-of-government framework

| Program | Spending Area | Government of Canada activity | – Actual Spending |

|---|---|---|---|

| Space Data, Information and Services | Government Affairs | Well-managed and efficient government operations | 170,632,929 |

| Space Exploration | Economic Affairs | An innovative and knowledge-based economy | 92,310,988 |

| Future Canadian Space Capacity | Economic Affairs | An innovative and knowledge-based economy | 79,004,716 |

| Spending Area | Total planned spending | Total actual spending |

|---|---|---|

| Economic affairs | 165,531,561 | 171,315,704 |

| Social affairs | 0 | 0 |

| International affairs | 0 | 0 |

| Government affairs | 215,086,072 | 170,632,929 |

Financial Statements and Financial Statements Highlights

Financial Statements

The Canadian Space Agency's financial statements unaudited for the year ended , are available on the Canadian Space Agency's website.

Financial Statements Highlights

The financial highlights presented below are intended to serve as a general overview of the Canadian Space Agency's financial position and operations. More detailed information is provided in the CSA's financial statements available online in the section on Departmental Results Reports (DRRs), which are prepared using an accrual accounting basis. Below are explanations for the variances in each major grouping based on the most significant factors that affected each grouping during –.

| Financial Information | – Planned Results |

– Actual |

– Actual |

Difference (– actual minus – planned) | Difference (– actual minus – actual) |

|---|---|---|---|---|---|

| Total expenses | 370,551,421 | 341,383,133 | 317,670,747 | (29,168,288) | 23,712,386 |

| Total revenues | - | 35,825 | 22,733 | 35,825 | 13,092 |

| Net cost of operations before government funding and transfers | 370,551,421 | 341,347,308 | 317,648,014 | (29,204,113) | 23,699,294 |

Total planned expenses for – were $370.6 million, an overstatement of $29.2 million compared to actual results of $341.4 million. The variance between planned and actual expenses is mainly explained by the following:

- Amortization expenses of assets under construction, planned to be capitalized to capital assets in –, being lower than projected ($6.0 million) as well as the extension of the remaining useful life of the International Space Station's assets ($21.8 million).

The residual difference of $1.4 million is composed of multiple variations arising from planned forecasts established in compared to the actual results.

Total – expenses add up to $341.4 million, a $23.7 million increase over the previous year's total expenses of $317.7 million. The increase is mainly explained by the following:

- A $14.9 million increase in the acquisition of machinery and material expense category is explained mainly by more RADARSAT-2 data (imagery) purchases under the Space Data, Information and Services Program; and

- A $10.9 million increase in transfer payments is mainly attributable to variations in ESA's payment schedules.

The residual difference of $2.1 million is composed of multiple variations arising from the – actual results compared to the – actual results.

The Agency's total revenues were $0.03 million in – ($0.02 million in –). For the purpose of this report, this amount represents the respendable part of the revenues which are 0.3% of the Agency's generated revenues of $10.0 million. This remained stable from –. The majority are reported under the sale of goods and services provided by the DFL, i.e. sale of goods and services to private business or other GoC departments, lease and use of public property as well as other revenues (penalties revenues).

| Financial Information | – | – | Difference (– minus –) |

|---|---|---|---|

| Total net liabilities | 104,184,547 | 115,500,963 | (11,316,416) |

| Total net financial assets | 98,091,348 | 108,050,031 | (9,958,683) |

| Departmental net debt | 6,093,199 | 7,450,932 | (1,357,733) |

| Total non-financial assets | 1,571,031,200 | 1,509,888,489 | 61,142,711 |

| Departmental net financial position | 1,564,938,001 | 1,502,437,557 | 62,500,444 |

Total net liabilities of $104.2 million are mostly made up of accounts payable and accrued liabilities represented by $94.4 million (90.6%). These represent goods and services received at year-end but that have not been paid by the Agency. Some of the most significant liabilities recorded at year-end are for the International Space Station, under the Space Exploration Program, for the RADARSAT Constellation Mission (RCM), under the Space Data, Information and Services Program and for transfer payments to ESA under the Future Canadian Space Capacity Program.

The $11.3 million decrease in net liabilities ($104.2 million for – compared to $115.5 million for –) is mainly explained by a $13.5 million decrease in accounts payable for the International Space Station. These variations are normal as payment schedules may vary from one year to another.

Total assets were $1.67 billion at the end of – ($98 million of net financial assets and $1.51 billion of non-financial assets), a $51.2 million (3.2%) increase compared with the previous year's total of $1.62 billion. The variance is mainly due to the increase in tangible capital assets for the RADARSAT Constellation Mission (RCM).

Non-financial assets are mainly composed of space-related assets ($1.36 billion or 90%).

Supplementary information

Corporate information

Organizational Profile

Minister of Innovation, Science and Economic Development:

The Honourable Navdeep Bains, P.C., M.P.

Minister of Science:

The Honourable Kirsty Duncan, P.C., M.P.

Minister of Small Business and Tourism and Leader of the Government in the House of Commons:

The Honourable Bardish Chagger, P.C., M.P.

Institutional Head:

Sylvain Laporte, President

Ministerial Portfolio:

Innovation, Science and Economic Development

Enabling Instrument(s):

Canadian Space Agency Act, S.C. , c. 13

Year of Incorporation / Commencement:

Established in

Other:

The Canadian Space Agency was established in . Approximately 84% of its employees work at the headquarters located at the John H. Chapman Space Centre, in St-Hubert, Quebec. The remaining personnel serve the CSA at the David Florida Laboratory in Ottawa, Ontario and its Policy and planning offices in Gatineau, Quebec, with officials in Houston, Washington and Paris.

Reporting framework

The Canadian Space Agency Strategic Outcome and Program Alignment Architecture of record for – are shown below:

1. Strategic Outcome: Canada's exploration of space, provision of space services and development of its space capacity meet the nation's needs for scientific knowledge, innovation and information.

- 1.1 Program: Space Data, Information and Services

- 1.1.1 Sub-Program: Earth Orbit Satellite Missions and Technology

- 1.1.1.1 Sub-Sub-Program: Earth Observation Missions

- 1.1.1.2 Sub-Sub-Program: Communications Missions

- 1.1.1.3 Sub-Sub-Program: Scientific Missions

- 1.1.2 Sub-Program: Ground Infrastructure

- 1.1.2.1 Sub-Sub-Program: Satellite Operations

- 1.1.2.2 Sub-Sub-Program: Data Handling

- 1.1.3 Sub-Program: Space Data, Imagery and Services Utilization Development

- 1.1.3.1 Sub-Sub-Program: Earth Observation Data and Imagery Utilization

- 1.1.3.2 Sub-Sub-Program: Communications Services Utilization

- 1.1.3.3 Sub-Sub-Program: Scientific Data Utilization

- 1.1.1 Sub-Program: Earth Orbit Satellite Missions and Technology

- 1.2 Program: Space Exploration

- 1.2.1 Sub-Program: International Space Station (ISS)

- 1.2.1.1 Sub-Sub-Program: International Space Station Assembly and Maintenance Operations

- 1.2.1.2 Sub-Sub-Program: International Space Station Utilization

- 1.2.2 Sub-Program: Exploration Missions and Technology

- 1.2.2.1 Sub-Sub-Program: Space Astronomy Missions

- 1.2.2.2 Sub-Sub-Program: Planetary Missions

- 1.2.2.3 Sub-Sub-Program: Advanced Exploration Technology Development

- 1.2.3 Sub-Program: Human Space Missions and Support

- 1.2.3.1 Sub-Sub-Program: Astronaut Training and Missions

- 1.2.3.2 Sub-Sub-Program: Operational Space Medicine

- 1.2.3.3 Sub-Sub-Program: Health and Life Sciences

- 1.2.1 Sub-Program: International Space Station (ISS)

- 1.3 Program: Future Canadian Space Capacity

- 1.3.1 Sub-Program: Space Expertise and Proficiency

- 1.3.2 Sub-Program: Space Innovation and Market Access

- 1.3.2.1 Sub-Sub-Program: International Market Access

- 1.3.2.2 Sub-Sub-Program: Enabling Technology Development

- 1.3.3 Sub-Program: Qualifying and Testing Services

- 1.4 Internal Services

Supporting information on lower-level programs

Supporting information on results, financial and human resources relating to the Canadian Space Agency's lower-level programs is available on TBS InfoBase.

Supplementary information tables

The following supplementary information tables are available on the Canadian Space Agency's website.

- Details on transfer payment programs of $5 million or more

- Internal audits and evaluations

- Response to parliamentary committees and external audits

- Status report on projects operating with specific Treasury Board approval

- Status report on transformational and major Crown projects

- User fees, regulatory charges and external fees

Federal tax expenditures

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expenditures. This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs. The tax measures presented in this report are the responsibility of the Minister of Finance.

Organizational contact information

Canadian Space Agency

Communications and Public Affairs

Telephone: 450-926-4370

Fax: 450-926-4352

Email: asc.medias-media.csa@canada.ca

Appendix: definitions

- appropriation (crédit)

-

Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- budgetary expenditures (dépenses budgétaires)

-

Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

- Core Responsibility (responsabilité essentielle)

-

An enduring function or role performed by a department. The intentions of the department with respect to a Core Responsibility are reflected in one or more related Departmental Results that the department seeks to contribute to or influence.

- Departmental Plan (Plan ministériel)

-

Provides information on the plans and expected performance of appropriated departments over a three-year period. Departmental Plans are tabled in Parliament each spring.

- Departmental Result (résultat ministériel)

-

A Departmental Result represents the change or changes that the department seeks to influence. A Departmental Result is often outside departments' immediate control, but it should be influenced by program-level outcomes.

- Departmental Result Indicator (indicateur de résultat ministériel)

-

A factor or variable that provides a valid and reliable means to measure or describe progress on a Departmental Result.

- Departmental Results Framework (cadre ministériel des résultats)

-

Consists of the department's Core Responsibilities, Departmental Results and Departmental Result Indicators.

- Departmental Results Report (Rapport sur les résultats ministériels)

-

Provides information on the actual accomplishments against the plans, priorities and expected results set out in the corresponding Departmental Plan.

- Evaluation (évaluation)

-

In the Government of Canada, the systematic and neutral collection and analysis of evidence to judge merit, worth or value. Evaluation informs decision making, improvements, innovation and accountability. Evaluations typically focus on programs, policies and priorities and examine questions related to relevance, effectiveness and efficiency. Depending on user needs, however, evaluations can also examine other units, themes and issues, including alternatives to existing interventions. Evaluations generally employ social science research methods.

- full-time equivalent (équivalent temps plein)

-

A measure of the extent to which an employee represents a full person-year charge against a departmental budget. Full-time equivalents are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements.

- government-wide priorities (priorités pangouvernementales)

-

For the purpose of the – Departmental Plan, government-wide priorities refers to those high-level themes outlining the government's agenda in the Speech from the Throne, namely: Growth for the Middle Class; Open and Transparent Government; A Clean Environment and a Strong Economy; Diversity is Canada's Strength; and Security and Opportunity.

- horizontal initiatives (initiative horizontale)

-

An initiative where two or more federal organizations, through an approved funding agreement, work toward achieving clearly defined shared outcomes, and which has been designated (for example, by Cabinet or a central agency) as a horizontal initiative for managing and reporting purposes.

- Management, Resources and Results Structure (Structure de la gestion, des ressources et des résultats)

-

A comprehensive framework that consists of an organization's inventory of programs, resources, results, performance indicators and governance information. Programs and results are depicted in their hierarchical relationship to each other and to the Strategic Outcome(s) to which they contribute. The Management, Resources and Results Structure is developed from the Program Alignment Architecture.

- non-budgetary expenditures (dépenses non budgétaires)

-

Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

- performance (rendement)

-

What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

- performance indicator (indicateur de rendement)

-

A qualitative or quantitative means of measuring an output or outcome, with the intention of gauging the performance of an organization, program, policy or initiative respecting expected results.

- performance reporting (production de rapports sur le rendement)

-

The process of communicating evidence-based performance information. Performance reporting supports decision making, accountability and transparency.

- planned spending (dépenses prévues)

-

For Departmental Plans and Departmental Results, planned spending refers to those amounts that receive Treasury Board approval by February 1. Therefore, planned spending may include amounts incremental to planned expenditures presented in the Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports.

- plans (plans)

-

The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead up to the expected result.

- priorities (priorité)

-

Plans or projects that an organization has chosen to focus and report on during the planning period. Priorities represent the things that are most important or what must be done first to support the achievement of the desired Strategic Outcome(s).

- program (programme)

-

A group of related resource inputs and activities that are managed to meet specific needs and to achieve intended results and that are treated as a budgetary unit.

- Program Alignment Architecture (architecture d'alignement des programmes)

-

A structured inventory of an organization's programs depicting the hierarchical relationship between programs and the Strategic Outcome(s) to which they contribute.

- results (résultat)

-

An external consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead they are within the area of the organization's influence.

- statutory expenditures (dépenses législatives)

-

Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

- Strategic Outcome (résultat stratégique)

-

A long-term and enduring benefit to Canadians that is linked to the organization's mandate, vision and core functions.

- sunset program (programme temporisé)

-

A time-limited program that does not have an ongoing funding and policy authority. When the program is set to expire, a decision must be made whether to continue the program. In the case of a renewal, the decision specifies the scope, funding level and duration.

- target (cible)

-

A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

- voted expenditures (dépenses votées)

-

Expenditures that Parliament approves annually through an Appropriation Act. The Vote wording becomes the governing conditions under which these expenditures may be made.