Evaluation of the Space Astronomy Missions and Planetary Missions Programs

From the period from to

Project # 16/17 02 - 02

Prepared by the Audit and Evaluation Directorate

Table of contents

- List of tables and figures

- Acronyms used in the report

- Executive summary

- 1. Introduction

- 2. Background

- 3. Evaluation approach and methods

- 3.1 Purpose and scope

- 3.2 Evaluation issues and questions

- 3.3 Methods

- 3.3.1 Documentation review

- 3.3.2 Key informant interviews

- 3.3.3 E-surveys

- 3.3.4 Case studies

- 3.4 Limitations

- 4. Findings

- 4.1 Relevance (section 4. Findings)

- 4.2 Effectiveness (section 4. Findings)

- 4.2.1 Outputs

- 4.2.2 Immediate outcomes

- 4.2.3 Intermediate outcomes

- 4.2.4 Ultimate outcomes

- 4.3 Efficiency (section 4. Findings)

- 5. Conclusions and recommendation

- 6. Management response and action plan

- Appendices

List of tables and figures

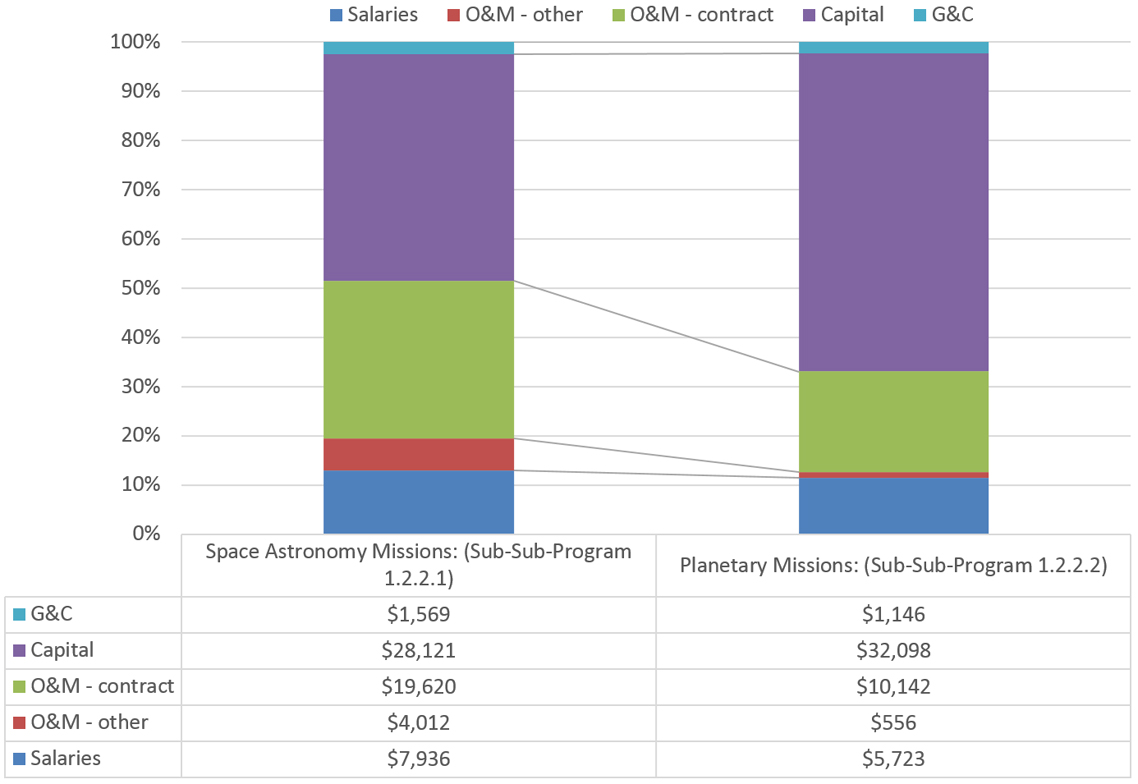

- Table 1: Resources allocated to the SAM & PM programs for the evaluation period

- Table 2: SAM annual overhead rates, –

- Table 3: PM annual overhead rates, –

- Table 4: SAM & PM combined annual overhead rates, –

- Figure 1: SAM & PM Missions by life-cycle phase, –

- Figure 2: SAM Planned vs Actual disbursements in $1,000s, –

- Figure 3: PM Planned vs Actual disbursements in $1,000s, –

- Figure 4: Distribution of total disbursements in $1,000s, –

Acronyms used in the report

- APXS: Alpha Particle X-Ray Spectrometer

- CAMS: Canadian ASTRO-H Metrology System

- CSA: Canadian Space Agency

- ESA: European Space Agency

- FGS: Fine Guidance Sensor

- FTE: Full-Time Equivalent

- G&C: Grants and Contributions

- GTO: Guaranteed Time Observation

- HFI: High Frequency Instrument

- HIFI: Heterodyne Instrument for the Far Infrared

- HQP: Highly Qualified Personnel

- JAXA: Japan Aerospace Exploration Agency

- JWST: James Webb Space Telescope

- LFI: Low Frequency Instrument

- LiDAR: Light Detection and Ranging

- MATMOS: Mars Atmospheric Trace Molecule Occultation Spectrometer

- MDA: MacDonald, Dettwiler and Associates

- MOU: Memorandum of Understanding

- MSL: Mars Science Lab

- NASA: National Aeronautics and Space Administration

- NIRISS: Near Infrared Imager and Slitless Spectrograph

- NRC: National Research Council Canada

- NSERC: Natural Sciences Research and Engineering Council of Canada

- Oc: Outcome

- OLA: OSIRIS-REx Laser Altimeter

- Op: Output

- O&M: Operations and Maintenance

- PI: Principal Investigator

- SAM & PM: Space Astronomy Missions & Planetary Missions

- SPIRE: Spectral and Photometric Imaging Receiver

- SSP: Sub-Sub Programs

- UVIT: Ultraviolet Imaging Telescopes

Executive summary

The Evaluation of the Space Astronomy Missions (SAM) and Planetary Missions (PM) programs of the Canadian Space Agency (CSA) was commissioned in by the Audit and Evaluation Directorate in accordance with the requirements of the Financial Administration Act and the Five-Year Departmental Evaluation Plan. The evaluation undertaken by Science-Metrix Inc. was conducted in accordance with the Treasury Board of Canada's Policy on Results and addressed the evaluation issues of relevance, effectiveness and efficiency. The present report constitutes the first evaluation of the SAM & PM programs. The timeframe of the evaluation covered the period from to during which time total disbursements amounted to over $110 million.

The CSA has been carrying out activities geared toward Canadian participation in space astronomy since and in planetary missions since . SAM encompasses the definition, design, technology development, implementation and use of complete Canadian space telescope systems and the provision of Canadian instruments, sensors and subsystems to international space telescope or probe missions. It generates scientific data about the universe through the observation of the solar system and deep space. PM encompasses the definition, design, technology development, implementation and use of Canadian exploration signature technologies and scientific instruments made available to international exploration missions. It supports the robotic exploration of remote bodies, such as planets and asteroids, to conduct detailed observations and science.

In carrying out this evaluation, a participatory approach was employed that entailed the use of mixed quantitative and qualitative methods. Specifically, document and archival data reviews were performed, e-surveys were administered to 41 funding recipients, and key informant interviews were conducted with 24 CSA representatives, one other government department, and 3 international partners. Two case studies were completed, one for each of the two programs under evaluation. The focus of these case studies was Canada's contribution to NASA's James Webb Space Telescope (JWST) mission and the Mars Science Lab (MSL)/Curiosity rover mission.

As a whole, the SAM & PM programs remain relevant and continue to meet the needs of the Canadian scientific community. With relatively modest investments, the SAM & PM programs were successful in obtaining access to space mission infrastructure that Canada on its own could never afford, such with JWST and the MSL. In exchange for these relatively modest investments, there were scientific, cultural and economic benefits for Canadians. It was also through this program that the Microvariability and Oscillations of STars telescope (MOST) was developed, the first CSA-led space astronomy mission in the history of Canada's space program.

Relevance

The SAM & PM programs are well aligned with the government's innovation agenda and the CSA's mandate and strategic outcome. The SAM & PM programs are essential to maintaining a world-class cadre of astronomers and planetary scientists in Canada dedicated to advancing the knowledge of space through scientific discovery. The current space astronomy and planetary missions that are in the development and operational phases will continue to meet the needs of their respective scientific communities with opportunities to conduct space exploration research, access scientific data and contribute to the advancement of knowledge for several years. The evaluation found that the SAM & PM programs are highly relevant to the CSA mandate and its strategic outcome as they develop Canada's space exploration capacities to advance the knowledge of space through science and technological innovation. In addition, the CSA is the only federal organization that provides the scientific community with access to space astronomy opportunities and data.

Effectiveness

The SAM & PM programs are very cost-effective and have achieved notable accomplishments which have contributed to Canada's reputation in the international space exploration community. Canada's participation in international partner space missions is contingent on making a contribution in the form of a science instrument, subsystem or related component. The space astronomy and planetary missions that Canada has led, such as MOST, or more often contributed to, included one or more science instruments and/or subsystems. Throughout the period of the evaluation, the SAM & PM programs have developed or operated 6 science instruments and 4 subsystems or spacecrafts. By , SAM & PM will meet or exceed their targets with two science instruments for space astronomy and planetary missions respectively, delivering data on a regular basis to the Canadian scientific community. The evaluation found that, at times, the engagement of the science teams was delayed due to a lack of grant funding at start-up and fragmented funding for scientific research during and after missions. The program should develop clear guidelines that clarify the definition and scope of science support to missions in order to allow for continuity in science support funding throughout all phases of a mission from pre-definition phase to post-operation activities.

Canada's success in space exploration missions is contingent on collaboration between industry, academia and government. The achievement of significant outcomes of the JWST and MSL missions, where government, academia and space industry partners worked collaboratively to deliver high-performance scientific instruments (NIRISS, APXS) and critical subsystems (FGS) are but a few examples of how Canada's international profile and reputation have been enhanced with each successfully completed mission deliverable. This has also resulted in a Canadian space exploration sector that is better positioned to seize space opportunities, and reuse its know-how and technology in future space missions to generate scientific discoveries.

The evaluation findings are unequivocal with respect to the positive contribution that the SAM & PM missions have made to Canada's space exploration profile and reputation. The combination of space-tested technologies, scientific and engineering know-how, and can-do attitude are often-noted characteristics of Canada's space exploration sector. Recognized as a trusted and reliable NASA partner, the CSA and its partners have been able to forge new partnerships to undertake space astronomy and planetary missions with the increasingly active space agencies of several other countries, including Japan and India and to export tested technologies and scientific instruments to other countries. However, the evaluation has also found that the irregular cadence of the SAM & PM programs has resulted in human and financial management challenges for industry partners and universities researchers, and uncertainty among international partners regarding Canada's financial commitments to ongoing and proposed missions. The enviable reputation that Canada has established over many years with its signature contributions to international joint ventures and high-profile space exploration missions may have been affected over the years due to the lack of investments.

Efficiency

The evaluation found that the program was very efficient with regards to leveraging and cost-efficiencies. The sustained data access and increased competence outcomes for the Canadian scientific community have been achieved at a very reasonable cost to the Government of Canada in comparison to the overall mission costs of its international partners. In exchange for these relatively modest investments come numerous benefits: scientific, cultural and even economic. The Canadian astronomy and planetary sciences communities have opportunities to influence the direction of the space research, design and deliver their own scientific instruments, have guaranteed time of observation, and priority access to the research data for at least six months. These advantages are not negligible and serve to maintain Canada's influential position among the leaders in space exploration research, which is a source of pride and inspiration to attract and retain highly qualified personnel in the science, technology, engineering and mathematics disciplines that are essential to an innovative and productive Canadian economy.

1. Introduction

The mandate of the Canadian Space Agency (CSA) is "to promote the peaceful use and development of space, to advance the knowledge of space through science and to ensure that space science and technology provide social and economic benefits for Canadians

."Footnote 1 Established in , with a status equivalent to that of a Department of the Government of Canada, the CSA is responsible for the coordination and implementation of space policies and programs, the application and diffusion of space technology, and the promotion of commercial exploitation of space.

The CSA Audit and Evaluation Directorate commissioned the services of Science-Metrix to undertake an Evaluation of CSA's Space Astronomy Missions (SAM) and Planetary Missions (PM) programs as per the Five-Year Departmental Evaluation Plan and in accordance with the Treasury Board of Canada's Policy on Results.Footnote 2 The evaluation was conducted during the – fiscal year, under the direction of the CSA's Audit and Evaluation Directorate (specifically, the CSA's Evaluation function) and covers the period from to .

2. Background

2.1 Program profile

The CSA has been carrying out activities geared toward Canadian participation in space astronomy since and in planetary missions since . Following restructuring of the CSA in – and the implementation of the CSA's Program Alignment Architecture in –, the SAM & PM programs have been identified as sub-sub-programs (SSPs) 1.2.2.1 and 1.2.2.2, respectively, which fall under the sub-program Exploration Missions and Technology 1.2.2, which in turn falls under the CSA's Space Exploration Program 1.2. In the interests of concision, the two sub-sub-programs under evaluation shall be referred to as programs throughout this report.

Space Astronomy Missions (SSP 1.2.2.1) encompasses the definition, design, technology development, implementation and use of complete Canadian space telescope systems and the provision of Canadian instruments, sensors and subsystems to international space telescope or probe missions. It generates scientific data about the universe through the observation of the solar system and deep space.Footnote 3

Planetary Missions (SSP 1.2.2.2) encompasses the definition, design, technology development, implementation and use of Canadian exploration signature technologies and scientific instruments made available to international exploration missions. It supports the robotic exploration of remote bodies (planets, asteroids, etc.) to conduct detailed observations and science.Footnote 4

2.2 Program theory of change

The SAM & PM logic model presented in Appendix A provides a visual representation of the means by which resources that are allocated to the programs are used to produce key outputs, leading to the achievement of expected outcomes. The following narrative drawn from the SAM & PM programs' Performance Measurement StrategyFootnote 5 describes these expected program outcomes and the program theory of change.

The SAM & PM programs have four immediate outcomes (Oc):

- Sustained Access to Scientific Data (Oc1): Space astronomy and planetary exploration science investigations and science instruments generate scientific data related to the solar system, our galaxy and the universe. In order to maximize returns, in the longer term, the data are made available to Canadian researchers by processing data and providing access to archived data or curated samples. This immediate outcome leads to increased knowledge about the Universe, solar system and human capacity to live in Space (Oc7).

- Increased Number of Highly Qualified Personnel (Oc2): The SAM & PM programs provide opportunities for individuals and organizations in the private and academic sectors to showcase their capabilities. Space astronomy and planetary missions create professional opportunities to develop and employ highly qualified personnel (HQP) in Canada, sometimes through participation in international missions. As a consequence, the number of HQP in space astronomy and planetary exploration in Canada is increased. For HQP measurement, the definition found in the State of the Canadian Space Sector report is used and entails tracking the number of employed engineers, scientists and technicians.Footnote 6 In this case, HQP will be specifically for space astronomy and planetary missions. This immediate outcome leads to a Canadian Space Exploration Sector that is better positioned to seize space opportunities (Oc5) and increased knowledge about the universe, solar system and human capacity to live in space (Oc7).

-

Expanded Canadian Presence in Space through Space Missions (Oc3): For this outcome, the expression "

presence in space

" is used in an inclusive way, from activities in low Earth orbit, to instruments (probes) sent to solar system bodies to enable conduct of science investigations and the operation of science instruments, as well as subsystems or spacecraft. Examples of expanded Canadian presence in space for the PM program include the rover Curiosity of the Mars Science Laboratory mission, which carries a Canadian science instrument (the Alpha Particle X-ray Spectrometer), and the ExoMars rover, which will carry two Canadian subsystems contributions (Bogie Electromechanical Assembly and Navigation cameras). An example for the SAM program is the Fair Ultraviolet Spectroscopic Explorer (FUSE) telescope, which operated the Canadian-built Fine Error Sensor camera system used to stabilize and point with extreme precision.Given the relatively small size of the CSA's space exploration program in comparison to that of other nations, Canada's preferred option is to partner with other space agencies. To ensure that such missions contribute to achieving objectives valued by the Government of Canada, the SAM & PM programs work with the Canadian space exploration sector to contribute science investigations, instruments, and subsystems and spacecraft. As a result of having demonstrated its capacity through delivery of space astronomy or planetary missions, a space sector entity is in a better position to respond to national and international mission opportunities when they arise, or to transfer technology and know-how. This immediate outcome leads to the transfer of know-how and technology to other applications (Oc5), and to seizing other space opportunities (Oc6).

- Increased Competence of Space Sector in Space Exploration Areas (Oc4): Competencies in space astronomy or planetary exploration missions are developed and maintained by industrial or academic entities in Canada. These competencies span such fields as analyzing data from space, conceiving missions, and developing or operating scientific instruments and subsystems or spacecraft. Competencies concerning the production of spacecraft or subsystems place the Canadian space exploration sector, industry and academia in a position to generate intellectual property, in the form of registered trademarks, patents, copyrights or industrial designs. This outcome may lead to transfer of know-how and technology to other applications, or to seizing other space opportunities (i.e., Oc5 and Oc6).

The SAM & PM programs have three intermediate outcomes:

- Canadian Space Exploration Sector Is Better Positioned to Seize Space Opportunities (Oc5): For this outcome, space opportunities refer to national endeavours dealing with space astronomy or planetary exploration, as well as to international missions that foreign space agencies embark on regularly. Demonstrated experience in dealing with the space environment is sought after by foreign space agencies. As the industrial or academic entities have produced spacecraft, subsystems or instruments, or as HQP have worked with space data, they are in a better position to seize opportunities that occur in space astronomy or planetary missions. This outcome leads to sustained economic growth (Oc8) and an enhanced space exploration profile in Canada and abroad (Oc9).

- Enhanced Transfer of Know-how and Technology to Other Applications (Oc6): The high level of ingenuity involved in developing and operating spacecraft, subsystems and science instruments that enable machines and humans to function in space generates innovative know-how (expertise, processes) and technology that is often applied for other purposes, either in space or on Earth. Technology can be transferred to another space device or it can be adapted and transferred to a device that will be used on Earth. Working with innovative space technologies increases the likelihood that additional applications can be found. This outcome contributes to economic growth (Oc8) and to the space exploration profile (Oc9).

- Increased Knowledge about the Universe, Solar System and Human Capacity to Live in Space (Oc7): By applying state-of-the-art technologies to realize space missions, as well as by seizing opportunities, the resulting foremost science investigations push the limits of our knowledge about the universe and the solar system. The SAM & PM programs contribute to discoveries concerning the nature and origin of the universe and solar system, and the capacity for humans to live and work in space. This outcome leads to Oc9, an enhanced space exploration profile in Canada and abroad.

The SAM & PM programs have two ultimate outcomes:

-

Sustained Economic Growth (Oc8): If the industrial and academic entities in the Canadian space exploration sector are better positioned to capture opportunities because of their expertise in producing spacecraft and subsystems, they can generate additional business. The industrial or academic entities are then in a position to gain more contracts, nationally or internationally.

Some of the products or technologies initially transferred to new applications on a small scale may eventually prove to be so useful that they become commercially viable and make significant contributions to the Canadian economy. Foreign space agencies have documented many examples of products, processes and technologies developed for space exploration that have been adapted for non-space consumer products and services. Oc5 contributes to this ultimate outcome because as opportunities are grasped, new avenues are available for new participants to expand the economic sphere. Transfer of know-how and technology to other applications (Oc6) also contributes to this ultimate outcome because adaptations from space use to non-space use (new consumer products) contribute to job creation in the industry or academic sectors and generate economic growth in general.

- Enhanced Space Exploration Profile in Canada and Abroad (Oc9): In the context of this ultimate outcome, the space exploration profile has three broad components:

- citizens' involvement,

- scientific results, and

- geopolitical impacts (bilateral and multilateral collaborations and partnerships with other countries).

It is generally recognized that space exploration, more specifically space astronomy and planetary exploration, has the capacity to inspire citizens by opening up new horizons, literally and figuratively. One way to achieve that is through the popularization of knowledge gained from science investigations. That knowledge, which has been reflected in important journal publications (Oc7), will be presented in popular magazines and other media accessible to a broader public. The wonders of exploration, demonstrated among other things by the Canadian presence in space through space missions (Oc3), may pique Canadians' curiosity and bring them to seek more information about astronomy or planetary exploration through newspaper articles, webpages or social media. Enhancing the profile in Canada refers to how Canadians react to the different activities and missions taking place in space when Canadian competence is demonstrated after providing functional subsystems or instruments (Oc4).

The profile of space exploration can be enhanced by the scientific results (Oc1, Oc2 and Oc7) delivered by planetary rovers, space telescopes or other science instruments. Though Canada's funding in exploration research is modest compared to other countries, its world-class expertise is sought by those same countries and their respective space agencies. The quality of the Canadian scientific results is demonstrated by leading organizations (such as the Organisation for Economic Cooperation and Development) that reference the data and information. The perception on the international scene of Canadian research in space astronomy and planetary missions enhances the profile of space exploration.

The profile of space exploration can also be enhanced by the realization that cooperation is very often needed between countries as they pursue very expensive endeavours. That cooperation, related to scientific or technological domains (Oc5, Oc6 or Oc7), is not simply done from agency to agency but requires that governments be involved. The International Space Station is a good example of such cooperation taking place at government level. More specifically, the Canadian contributions to the James Webb Space Telescope or to the Curiosity rover have also required that cooperation between companies and universities be framed by governmental agreements. Participation in international space astronomy or planetary missions may help position Canada as a dependable partner, enhancing international relations on many fronts and branding Canada as an innovative, forward-looking nation. Thus the space astronomy and planetary mission outcomes (Oc3, Oc5, Oc6 and Oc7) are aligned with enhancing Canada's national and international profile in research and engineering activities.

2.3 Governance and roles and responsibilities

The Director General of Space Exploration is accountable to the President of the CSA and chairs the Space Exploration Management Committee in order to ensure effective coordination of all financial or human resources across the sub-programs under his authority. The Director, Space Exploration Development is responsible for carrying out the decisions taken by the Space Exploration Management Committee that pertain to his directorate, which includes the SAM & PM programs. Respective managers of the SAM and PM programs direct their employees toward executing and implementing those programs' activities.

2.4 Key stakeholders

Both the SAM & PM programs are performed in collaboration with the International Space Exploration Coordination Group, foreign space agencies, Government of Canada organizations and through consultations with the Canadian astronomical community. This collaborative effort takes shape under contracts, grants and contributions (G&Cs), memoranda of understanding (MOU) with other government departments, and international partnership agreements.

According to the SAM & PM programs' Performance Measurement Strategy,Footnote 7 the programs' key stakeholders include the following:

- Private enterprises (small, medium or large) involved in development of science and technology related to space exploration

- Academic institutions, research centres and universities involved in research and development of science and technology related to space exploration

- Foreign space agencies, such as the National Aeronautics and Space Administration (NASA), the European Space Agency (ESA), the Japan Aerospace Exploration Agency (JAXA), the Indian Space Research Organisation, as well as a few national space agencies in Europe

- Other government departments, such as the National Research Council Canada (NRC), the Natural Sciences and Engineering Research Council of Canada (NSERC), the Canadian Foundation for Innovation, Public Service and Procurement Canada, and the Treasury Board of Canada Secretariat. Although both NSERC and the Canadian Foundation for Innovation do not play a direct role in SAM & PM missions, they provide research infrastructure funding for Canadian scientists.

2.5 Resource allocation

The CSA's annual A-Base budget of $300 million was initially established in Budget ($215.4 million in dollars), and is now in the order of $260 million. Table 1 shows the total human and financial resources allocated to the SAM & PM programs, as well as the actual spending over the course of the evaluation period.

| Type of Resource | – | – | – | – | – |

|---|---|---|---|---|---|

| FTEsTable note a | |||||

| SAM | 17.7 | 16.7 | 12 | 6 | 6 |

| PM | 11.2 | 9.9 | 10.6 | 9.5 | 9.6 |

| Total | 28.9 | 26.6 | 22.6 | 15.5 | 15.6 |

| Forecasted Budget (,000$)Table note b,Table note c | |||||

| SAM | 18,311 | 17,094 | 9,422 | 11,189 | 5,942 |

| PM | 10,794 | 23,551 | 16,959 | 12,492 | 5,864 |

| Total | 29,105 | 40,645 | 26,381 | 23,681 | 11,806 |

| 5-year total = 131,618 (SAM = 61,958; PM = 69,660) | |||||

| Actual Spending (,000$) | |||||

| SAM | |||||

| Salary Table note c | 2,271 | 2,153 | 1,611 | 987 | 914 |

| O&M - other Table note d | 892 | 671 | 743 | 802 | 904 |

| O&M - contracts | 4,406 | 5,424 | 4,699 | 3,316 | 1,775 |

| Capital | 5,741 | 6,055 | 4,391 | 8,519 | 3,415 |

| G&C | 285 | 308 | 318 | 317 | 341 |

| Sub-total | 13,595 | 14,611 | 11,761 | 13,942 | 7,348 |

| PM | |||||

| Salary | 1,222 | 1,091 | 1,173 | 1,120 | 1,117 |

| O&M - other Table note d | 154 | 224 | 65 | 59 | 53 |

| O&M - contracts | 2,923 | 2,946 | 1,503 | 1,493 | 1,278 |

| Capital | 236 | 4,050 | 15,825 | 7,356 | 4,631 |

| G&C | 236 | 175 | 211 | 262 | 263 |

| Sub-total | 4,771 | 8,486 | 18,777 | 10,290 | 7,342 |

| Total | 18,366 | 23,460 | 30,555 | 24,363 | 14,728 |

| 5-year total = 110,923 (SAM = 61,258; PM = 49,665) | |||||

Table Notes:

- Table note a

-

FTEs are full-time equivalents.

- Table note b

-

As approved in annual work plans.

- Table note c

-

Excludes employee benefit plan.

- Table note d

-

MOUs and travel.

Source: The CSA's Finance Directorate,

2.6 Prior evaluation of the Program

This report constitutes the first evaluation of the SAM & PM programs. The Performance Measurement Strategy for the SAM & PM programs was developed in and revised in .

3. Evaluation approach and methods

3.1 Purpose and scope

In keeping with requirements stipulated in the Policy on Results and Directive on Results, the Financial Administration Act, and the planned evaluations from the CSA's Five-Year Departmental Evaluation Plan, this cluster evaluation of the SAM & PM programs will include all aspects of the SAM & PM programs corresponding to the Program Alignment Architecture activities 1.2.2.1 and 1.2.2.2, respectively. The objective of the evaluation will be to systematically collect and analyze evidence on the relevance, effectiveness and efficiency of these programs, as well as unintended outcomes for the reporting period from to .

3.2 Evaluation issues and questions

The following evaluation issues and questions represent the key themes of the evaluation that were expanded upon and tailored to the appropriate informants in the interview protocols.

- Relevance

-

- Are the SAM & PM outcomes aligned with federal government priorities?

- Are the SAM & PM outcomes aligned with departmental strategic outcomes?

- Are the SAM & PM programs consistent with federal roles and responsibilities?

- Do the SAM & PM programs continue to address a demonstrable need?

- Effectiveness – Outputs (Op)

-

- Have science investigations been enabled and supported? (Op1)

- Are science instruments under development or operated in space? (Op2)

- Are spacecraft or subsystems under development or operated in space? (Op3)

- Effectiveness – Outcomes (Oc)

-

- Is there sustained access to scientific data? (Oc1 (Immediate))

- Have the number of HQP been increased? (Oc2 (Immediate))

- Has Canadian presence in space been expanded through space missions? (Oc3 (Immediate))

- Has the competence of the space sector in space exploration areas been increased? (Oc4 (Immediate))

- Is the Canadian space exploration sector better positioned to seize space opportunities? (Oc5 (Intermediate))

- Has the transfer of know-how and technology to other applications been enhanced? (Oc6 (Intermediate))

- Has knowledge about the universe, solar system and human capacity to live in space been increased? (Oc7 (Intermediate))

- Has there been sustained economic growth? (Oc8 (Ultimate))

- Has the space exploration profile in Canada and abroad been enhanced? (Oc9 (Ultimate))

- Efficiency

-

- To what extent is the program delivering outputs and achieving outcomes in the most efficient manner?

- To what extent has resource use been minimized in the implementation and delivery of the program?

3.3 Methods

3.3.1 Documentation review

Documents external and internal to the SAM & PM programs were reviewed for content to evaluate the programs' continued relevance. Performance data pertaining to the achievement of the programs' outputs and outcomes over the evaluation time frame were documented in the Report on Performance Measurement for Sub-sub Programs SAM & PMFootnote 8 and a variety of files. The external documentation included various strategy papers, expert panel reports, assessments and industry submissions, as well as Government of Canada statements on the importance of research and development in the science, technology and innovation space. The internal documentation included Reports on Plans and Priorities, Departmental Performance Reports, the Performance Measurement Strategy, performance data and media tracking files, financial data files, summary reports on invitations received from international partners, and approximately 30 mission-level project files. Most of the documentation was loaded, coded and analyzed in Atlas.ti.

3.3.2 Key informant interviews

In-person group and individual interviews were conducted with CSA management and staff in Saint-Hubert. Twenty-four individuals participated in the interviews, including three director generals and the Program Director. All four planned interviews were conducted with representatives of NRC/Herzberg Institute of Astrophysics. Telephone interviews were conducted with three international partners; NASA, ESA and JAXA. All of the interviews were transcribed, loaded, coded and analyzed in Atlas.ti.

3.3.3 E-surveys

The e-survey was sent to 41 contact email addresses, one of which bounced back; 19 completed responses were received out of the remaining 40, for a response rate of 48%. The survey data cannot be considered statistically reliable because of the high margin of error. Nevertheless, valuable qualitative data were collected that provide an insight into how the SAM & PM programs are viewed by funding recipients.

3.3.4 Case studies

Two case studies were completed, one for each of the two programs under evaluation. The focus of these case studies was Canada's contribution to the NASA JWST mission and the Mars Science Lab/Curiosity rover mission. Two in-person group interviews of CSA staff involved in these missions were conducted, involving a total of six individuals. Telephone interviews were also conducted with NASA's program director for JWST, the Canadian principal investigators and an industry representative. Mission-level documentation and the transcribed interview notes were loaded, coded and analyzed in Atlas.ti.

3.4 Limitations

There are some limitations to the evaluation data set that has been collected. The absence of a robust data set from international partners has limited the evaluation's ability to fully assess the effect that the programs have had on Canada's international profile and visibility in space exploration. The limited availability and quality of archival data—that is, program performance measurement records covering each of the fiscal years in the evaluation time frame—has limited the evaluation's ability to fully assess the effectiveness of output production and the efficiency of resource utilization.

4. Findings

4.1 Relevance

The relevance of the SAM-PM programs was evaluated with regard to

- the linkages between program outcomes and federal government priorities,

- the linkages between program outcomes and departmental strategic outcomes,

- the role and responsibilities for the federal government in delivering the program, and

- the extent to which the program continues to address a demonstrable need and is responsive to the needs of Canadians.

4.1.1 Alignment with federal government priorities

Evaluation question #1 (Relevance): Are the SAM & PM outcomes aligned with federal government priorities?

Finding #1: The SAM & PM outcomes were aligned with the Canadian Space Policy Framework, prevailing federal government priorities for advancing science, technology and innovation to spur economic growth and prosperity, and recent Government of Canada announcements.

The importance of innovation as a contributing factor to future productivity and economic growth has long been accepted in Canada by government, academia and industry.Footnote 9,Footnote 10,Footnote 11 As follows, the review of federal support to research and development by a government-appointed, independent panel set out quite eloquently how innovation contributes to productivity.

In the context of productivity growth, the process of innovation diffusion and adaptation is most important, since most innovation that occurs in any given area or jurisdiction is through adaptation of significant innovations originating elsewhere. The adoption/ adaptation by an individual enterprise of a new or better way of doing something is therefore also recognized as a form of business innovation — indeed, the most common.Footnote 12

The CSA has traditionally accounted for the largest percentage of research and development contracted to Canadian business, estimated by Statistics Canada at $167 million or 60% of the total in –.Footnote 13 The important role that the CSA has played in supporting Canadian business innovation was evidenced in the Aerospace Review. Its recommendations focused on policy and program improvement specific to the space sector, including the establishment of a Canadian Space Advisory Council and Space Program Management Board, recognition of the importance of space technologies and capacity to economic prosperity and growth, stabilized core funding, and additional funding for technology development programs.Footnote 14

Made public in , Canada's Space Policy Framework was to serve as a guide for Canada's future space programming activities, including space exploration that would inspire young Canadians to pursue studies and careers in science and engineering. The Government committed to the following points:

- Ensuring that Canada is a sought-after partner in the international space exploration missions that serve Canada's national interests

- Continuing to invest in the development of Canadian contributions in the form of advanced systems and scientific instruments as part of major international endeavours

- Continuing Canada's Astronaut Program so as to have Canadians aboard current and future space laboratories and research facilitiesFootnote 15

The SAM & PM Performance Measurement Strategy was developed and approved shortly after the Space Policy Framework was made public. It drew its guidance from the framework's first two commitments, with emphasis placed on working with international space agency partners and contributing to joint international space exploration missions. Contained within the strategy is the SAM & PM Logic Model (Appendix A), which sets out the programs' outcomes with two clear streams of logic aligned with the Government's commitments for science, technology and innovation, as outlined above. The first stream of logic is focused on enhancing Canada's space exploration profile through advancing knowledge about the universe and our solar system, developing highly qualified personnel (HQP), and providing scientific communities with access to scientific data. The second is focused on generating economic growth through the transfer of know-how and technology to terrestrial and space applications by developing the competence of the Canadian space exploration sector, and through positioning the Canadian space exploration sector for future space opportunities by maintaining a presence in space through space missions. Both streams of logic and their ultimate outcomes addressed different aspects of the Government's Science and Technology Strategy to optimize Canada's people, knowledge and entrepreneurial advantages.Footnote 16

In , the Government of Canada released its renewed Science, Technology and Innovation Strategy, the objective of which was to "strengthen Canada's position as a global leader in scientific research and innovation

"Footnote 17 and "continue to support and deepen research across a broad spectrum of disciplines that include both discovery- and application-driven research.

"Footnote 18 The strategy was based upon three pillars. Encouraging young Canadians to pursue careers in science, technology, engineering and mathematics, as well as attracting and retaining HQP, were priorities of the strategy's People pillar. Supporting world-leading research with the potential to generate long-term economic benefits was a priority of the strategy's Knowledge pillar. Encouraging partnerships between academia and industry to drive innovation and position Canadian businesses in the global marketplace was a priority of the Innovation pillar.Footnote 19 This strategy affirmed the Government's intention to strengthen Canada's capacity for science and technology innovation and advanced research and development in sectors such as space exploration, where academia and industry would need government support. The SAM & PM outcomes remain well aligned with these priorities to inspire Canadians and advance space science capacity in order to position the country as a respected, innovation-driven and space-faring nation.

The Ministerial Mandate Letters for the Minister of Innovation, Science and Economic Development and the Minister of Science stated that the government intended to "to partner closely with businesses and sectors to support their efforts to increase productivity and innovation

"Footnote 20 and to ensure that "investments in scientific research, including an appropriate balance between fundamental research to support new discoveries and the commercialization of ideas, [lead] to good jobs and sustainable economic growth.

"Footnote 21 The SAM-PM programs have, generally, remained well aligned with government priorities. However, the implementation of these priorities specifically as they relate to the CSA's Space Exploration Program has caused some concern among internal interviewees given recent Government announcements. It should be noted that document review and interview data indicate the current Government's priorities have been reflected in recent announcements to fund human space flight and post-ISS space exploration among competing space priorities, while the SAM-PM programs have gone without a newly approved and funded mission since the beginning of the evaluation timeframe.

4.1.2 Alignment with the CSA's priorities

Evaluation question #2 (Relevance): Are the SAM & PM outcomes aligned with departmental strategic outcomes?

Finding #2: The SAM & PM outcomes were most directly aligned with supporting innovation, providing information and generating scientific knowledge, all integral to the CSA Strategic Outcome,

The evaluation's internal document review of the CSA's Reports on Plans and Priorities and Departmental Performance Reports covering the entire evaluation time frame reveals that the CSA's Strategic Outcome has remained unchanged as follows, "Canada's exploration of space, provision of space services, and development of its space capacity meet the nation's needs for scientific knowledge, innovation and information.

"Footnote 22,Footnote 23

The SAM & PM programs facilitate the participation of the Canadian space exploration sector, including academia and industry, in space astronomy and planetary missions most often sponsored by international space agency partners. These opportunities build on the existing strengths of the Canadian space industry and scientific community to contribute valued Canadian technologies and scientific expertise to the design, development and operation of spacecraft, subsystems, and/or scientific instruments.Footnote 24 Canada has demonstrated a world-class level of know-how, expertise and innovation on many international space astronomy and planetary exploration missions, making it a sought-after partner by space agencies around the world. This acknowledged capacity of the Canadian space exploration sector has taken years to develop and has given Canadian astronomers and planetary scientists access to scientific instruments and data that have led to new discoveries and advances in knowledge about the solar system and the universe.Footnote 25

The SAM & PM programs are well aligned with the CSA's Strategic Outcome and specific priorities identified in the – Report on Plans and Priorities, such as conducting "fundamental research and new discoveries

" and "positioning of the space sector for global opportunities.

"Footnote 26 The interview data confirm the strong alignment of these programs with the CSA's mandate related to "advancing the knowledge of space through science and technology.

"Footnote 27 The programs were acknowledged to be conducting scientific research, providing scientific data and facilitating the use of information to advance knowledge.

4.1.3 Alignment with federal roles and responsibilities

Evaluation question #3 (Relevance): Are the SAM & PM programs consistent with federal roles and responsibilities?

Finding #3: The SAM & PM programs are designed and were implemented in a manner consistent with the CSA mandate, one that is unique among federal government departments and agencies with respect to space exploration missions and technology.

The activities and objectives of the SAM & PM programs are consistent with the essential functions assigned to the CSA by the Canadian Space Agency Act, notably to "plan, direct, manage and implement programs and projects relating to scientific or industrial space research and development and the application of space technology,

" to "promote the transfer and diffusion of space technology to and throughout Canadian industry,

" and to "encourage commercial exploitation of space capabilities, technology, facilities and systems.

"Footnote 28

In the same vein, the Aerospace Review report highlighted that

The third category of space activity is space exploration and science, which focuses primarily on satisfying our thirst and need for fundamental knowledge. The inspiring feats of astronauts, missions to the moon and other planets, space labs, and deep-space telescopes expand our understanding of the universe and our place in it. They are wellsprings of national pride and prestige, and generate technological and economic spinoffs. Such activities are almost always government-funded and, given their scale and complexity, usually carried out through international cooperation.Footnote 29

The Aerospace Review report also recommended that the government "develop mechanisms to support the efforts of companies to keep their workforces technologically adept and adaptable through continual up-skilling.

"Footnote 30 Numerous other reports over the years have also encouraged the federal government to play an important role in supporting basic and applied research, as well as related training of HQP.Footnote 31,Footnote 32,Footnote 33 The National Research Council Canada (NRC) and the Natural Sciences and Engineering Research Council (NSERC), for example, have mandates related to research and the development of HQP.Footnote 34 NRC has responsibility for ground-based astronomy, but the CSA is the only agency that provides a scientific community with access to space astronomy opportunities and data. NSERC funds fundamental and applied scientific research, and was identified by e-survey respondents as another important funder of space research, although not in coordination with SAM & PM missions. Only the CSA has a mandate to "advance the knowledge of space through science and technology

" and does so in coordination with the NRC Canadian Astronomy Data Centre and with little duplication or overlap with other government departments.

The research, development and innovation that take place in the SAM & PM programs have been consistent with the CSA mandate as stated above. Providing space hardware (instruments, subsystems or whole spacecraft) requires specialized infrastructure, expertise and resources that no other government department or agency possesses. The interview data also suggest that the CSA is best positioned to develop a technologically adept workforce for the space sector, as well as HQP researchers to analyze the scientific data, in order to fulfill its scientific mandate and to contribute to Canada's competitive advantage.

Although outside the time frame of the evaluation, it is noteworthy that Budget affirmed that the federal government has an important role to play in advancing science, research and innovation in the pursuit of building a skilled and stronger middle class. Specifically for space exploration, the fact that the government decided to invest in a mission to Mars indicates that planetary exploration is a priority. Following through on this principle was an $80.9 million cash allocation to the CSA beginning in fiscal year – "to demonstrate and utilize Canadian innovations in space

" in the field of quantum technology and to support Canada's participation in NASA's next Mars Orbiter Mission.Footnote 35

4.1.4 Continued need for the Programs

Evaluation question #4 (Relevance): Do the SAM & PM programs continue to address a demonstrable need?

Finding #4: The SAM & PM programs are essential to maintaining a world-class cadre of astronomers and planetary scientists in Canada dedicated to advancing the knowledge of space through scientific discovery. In the absence of newly approved and funded missions since the beginning of the evaluation, international partners and the Canadian space industry have successfully sought out other partners and business opportunities.

Canada has a long and proud history as a space-faring nation, which is a source of national pride, prestige and inspiration for young Canadians to pursue careers in science, technology, engineering and mathematics fields. It seems only fitting that an evaluation of the continued need for these programs should be first examined from the perspective of the scientific communities involved.

The long history of astronomy in Canada, detailed in the James Webb Space Telescope (JWST) case study (Appendix B), has seen the Canadian astronomy community grow from roughly a hundred members in to approximately 300 professional astronomers and another 300 graduate and postgraduate students in universities across Canada. The community is among the most influential in the world in terms of its contribution to scientific advances in the field of astronomy and astrophysics. On the other hand, the planetary exploration community is relatively new, as described in the Mars Science Lab (MSL) case study (Appendix B). The community has grown from a small number of researchers at the turn of the millennium who conducted fundamental research that didn't require access to space, to an estimated 26 faculty members holding key research positions in top Canadian universities who have been or are currently science team members (Co-Investigators) in planetary exploration missions.

Of the SAM & PM funding recipients from academia and industry surveyed by the evaluation, 90% rated the continued need for these programs as significant, the highest rating possible. Three categories of needs were identified by the respondents:

- Advancing knowledge in astronomy and astrophysics through supporting the development of scientific instruments and technologies, enabling Canadian researchers to participate in international space missions, and producing and facilitating access to scientific data.

- Attracting highly qualified personnel and students to space-related research and improving their training.

- Supporting Canadian companies to innovate, develop and commercialize high-tech products and services.

The three main arguments put forward by e-survey and interview respondents in support of continued funding of the SAM & PM programs are summarized as follows.

- There is a need to continue the exploration of space in order to respond to fundamental questions about planets, our solar system, and the shape and composition of the universe. Respondents also indicated a need to understand the characteristics of the planet Mars and to develop new technologies to facilitate its exploration and habitation. Canadian involvement in space exploration through its leading scientists would contribute significantly to advancing knowledge in these areas.

- There are currently no funding alternatives to the SAM & PM programs to provide access to the space facilities, missions and scientific data that are essential for the conduct of world class scientific research and HQP training, without which the respective scientific communities in Canada would be diminished. It should also be noted that documented research and interview data indicate that at least 5 HQP have pursued opportunities in the United States and elsewhere, while others have also expressed their intention to do the same should there be a further decline of opportunities to conduct scientific research in their fields.

- The SAM & PM programs provide Canadian companies with the opportunity to develop advanced and reliable technologies for exceptionally challenging space applications that demonstrate their capacity to innovate, thereby raising their profiles and reputations internationally and making them more competitive in the international space marketplace.

The irregular cadence of the SAM & PM programs funding has been very challenging for the space industry leaders such as British Columbia-based MacDonald, Dettwiler and Associates (MDA) and Ontario-based COM DEV International (COM DEV), who have recently found new business partners in the United States. MDA's Canadian and US operations are now controlled by a US corporation with its headquarters in San Francisco.Footnote 36 In , the US company Honeywell announced the purchase of COM DEV International's space hardware and systems line of business,Footnote 37 leaving the space exploration business line in Cambridge, Ontario.

Similarly, international space agency partners (e.g., NASA, ESA) have formed other partnerships in the absence of Government of Canada support as evidenced in the MSL case study. The low interview response rate from international partners was revealing in this respect, as was the inability of respondents to answer many of the interview questions due to the amount of time that had passed since the last joint mission as "these missions took place many years ago.

" Canadian scientists' participation in international space agency missions and subsequent access to the scientific data are generally contingent on the provision of a technology hardware contribution supplied by a Canadian space industry firm and paid for by the Government of Canada. The evaluation found that there is a strong continued need for the SAM-PM programs to maintain the world-class scientific research conducted by Canadian space astronomy and planetary exploration community stakeholders. With a committed plan of mission approvals in the future, stakeholders would continue to benefit from the SAM-PM programs.

4.2 Effectiveness

This section presents the findings for the Effectiveness evaluation issues: output and outcome achievements. The extent to which the SAM & PM programs have achieved each of the outputs and outcomes identified in the logic model is evaluated in this section of the report, which is divided into output, immediate outcome, intermediate outcome and ultimate outcome sub-sections.

4.2.1 Outputs

Evaluation question #5 (Effectiveness): Have science investigations been enabled and supported?

Finding #5: The number of Canadian universities and research institutes undertaking science investigations enabled through G&Cs and in operation (supported through mission-related contracts) has remained relatively steady and above the set targets over the evaluation period. Support for science investigations in development has declined markedly; the number of investigations has fallen from nine to five for SAM and from seven to one for PM, although the programs still attained their reduced targets of one (1) investigation each.

Enabling science investigations refers to the development of knowledge by the scientific community involved in space missions in astronomy or planetary sciences. Science priorities are identified through information gathered about international opportunities and through consultations with the Canadian scientific community. Proposals are solicited through announcements of opportunities and funded with grants to the university proponents. These grant-funded projects can be used to increase the science returns of archived mission data or to define the science objectives and measurement needs for identified mission opportunities. Requests for proposals with well-defined statements of work are issued on a competitive basis and funded through contracts. Typical requirements have included business case input for mission opportunities, with option analysis, costing and scheduling, and the design and development of scientific instruments or subsystem concepts as part of pre-project activities for approved missions. Science investigations are supported to perform work for the CSA related to specific requirements of upcoming or ongoing space astronomy and planetary missions.Footnote 38

Targets of two (2) and six (6) science investigations enabled by Canadian universities were set for space astronomy and planetary missions respectively over the course of the evaluation time frame. In the case of space astronomy, three universities worked on the ASTRO-H CAMS subsystem, and one other worked on the Herschel SPIRE instrument for the first four years. A fifth university began to provide support in the last year on the ASTROSAT UVIT instrument. The number of universities providing science support to the MSL APXS instrument increased from two (2) to four (4) over the course of the five years. On the other hand, the number of universities providing support to the OSIRIS-REx OLA instrument declined from four (4) to two (2) over the last three years. Two science investigations were terminated in after the withdrawal of NASA and subsequently the CSA from the ESA ExoMARS mission. Both SAM & PM exceeded their targets for grant-funded science investigations enabled over the evaluation timeframe.Footnote 39

A target of one (1) science investigation under development and supported through contracts was set for each of the space astronomy and planetary missions over the course of the evaluation time frame. The target for space astronomy was exceeded considerably given the number of missions initially under consideration (e.g., EUCLID, SPICA) and in development (e.g., JWST – NIRISS/FGS, NEOSSat, ASTROSAT – UVIT, ASTRO-H CAMS). Similarly, the target for planetary missions was only exceeded in the first two years when Mars and the ExoMARS missions were under consideration, while MSL APXS was under development. Development of the OSIRIS-REx OLA instrument was initiated in – and has remained the only science investigation under development for this program since. The number of universities, research centres and private sector companies involved declined markedly from nine (9) to five (5) for space astronomy and seven (7) to one (1) for planetary missions over the time frame of the evaluation.Footnote 40

Evaluation question #6 (Effectiveness): Are science instruments under development or operated in space?

Finding #6: Canada's science instruments on the ESA Planck and Herschel missions, as well as Canada's own MOST space telescope, were in operation until , followed by the ASTROSAT – UVIT instrument, which became operational in –. The Canadian-built APXS on NASA's MSL mission has been operational since , while the JWST's NIRISS and the OSIRIS-REx's OLA have been in development. By , SAM & PM will meet or exceed their targets with two science instruments each, delivering data on a regular basis to the Canadian scientific community.

Evaluation question #7 (Effectiveness): Are spacecraft or subsystems under development or operated in space?

Finding #7: The space telescope MOST, launched in , was the only Canadian spacecraft in operation from during the evaluation timeframe while NEOSSat, the CAMS subsystem for ASTRO-H and the FGS subsystem for the JWST were in development. ASTRO-H was launched in and declared lost in . Small space telescopes and micro-satellites were developed and launched at a reasonable cost and had very specialized scientific data gathering missions.

Canada's participation in international partner space missions is contingent on making a contribution in the form of a science instrument, subsystem or related component. Open and formal invitations to participate in international missions generally specify the scientific or technology requirements sought after by the sponsoring space agency. More personalized invitations are sometimes extended to Canada when the Canadian space sector is known for specific technologies and capabilities. For example, as described in the JWST case study, NASA sought out Canada's contribution for a mission critical subsystem in the form of an infrared tunable camera that would allow the telescope to be aimed very precisely. Based on the interview data, COM DEV's technology and demonstrated capability was key to the invitation and contract award; it also facilitated the CSA's negotiation with NASA of a scientific instrument as part of its JWST contribution, which will generate data for the benefit of Canadian astronomers and astrophysicists.

The CSA led two space astronomy missions since the inception of Canadas's space program: MOST and NEOSSat. More often, CSA has contributed science instruments and/or subsystems to other space agencies' space astronomy or planetary missions. Figure 1 presents the past, present and future operational missions by life-cycle phase over the duration of the evaluation time frame, followed by a brief description of each mission, scientific instrument and subsystem based on the available internal documentation and web research.

Figure 1: SAM & PM Missions by life-cycle phase, –

Figure 1: SAM & PM Missions by life-cycle phase, – - Text version

Diagram displaying SAM & PM Missions by life-cycle phase between and . Two graphs are depicted. The first is depicted by 7 bars, representing projects of the Space astronomy missions. The second is depicted by 2 bars, representing projects of the Planetary Missions. Each color represents a different phase of the project.

Space Astronomy missions

- PLANCK (HFI, LFI)

- Concept and Design Phase: N/A

- Under Development Phase: N/A

- Launch and Operational Phase: -

- Mission End, Data Reduction Phase: -

- HERSCHEL (HIFI, SPIRE)

- Concept and Design Phase: N/A

- Under Development Phase: N/A

- Launch and Operational Phase: -

- Mission End, Data Reduction Phase: -

- MOST

- Concept and Design Phase: N/A

- Under Development Phase: N/A

- Launch and Operational Phase: -

- Mission End, Data Reduction Phase: -

- ASTRO-H (Hard X-Ray, CAMS)

- Concept and Design Phase: N/A

- Under Development Phase: -

- Launch and Operational Phase: -

- Mission End, Data Reduction Phase: -

- ASTROSAT (UVIT)

- Concept and Design Phase: N/A

- Under Development Phase: -

- Launch and Operational Phase: -

- Mission End, Data Reduction Phase: N/A

- NEOSSat

- Concept and Design Phase: N/A

- Under Development Phase: -

- Launch and Operational Phase: -

- Mission End, Data Reduction Phase: N/A

- JWST (NIRISS/FGS)

- Concept and Design Phase: N/A

- Under Development Phase: -

- Launch and Operational Phase: -

- Mission End, Data Reduction Phase: N/A

Planetary missions

- MSL (APXS)

- Concept and Design Phase: N/A

- Under Development Phase: -

- Launch and Operational Phase: -

- Mission End, Data Reduction Phase: N/A

- OSIRIS-REx (OLA)

- Concept and Design Phase: N/A

- Under Development Phase: -

- Launch and Operational Phase: -

- Mission End, Data Reduction Phase: N/A

Source: Internal document and file review

Canadian instruments:

- Planck – HFI/LFI

-

This ESA mission was launched in , along with the Herschel Space Observatory, and ended in . The Planck mission objectives were to study the cosmic microwave background's anisotropies and polarization—exploring the birth of the universe, its evolution and the forms that it might take in the future. Planck carried two instruments: High Frequency Instrument (HFI) and Low Frequency Instrument (LFI). The CSA funded quick-look analysis and trending software and science support for both instruments, along with data reduction and post-operations support until .

- Herschel – HIFI/SPIRE

-

The Herschel Space Observatory mission was launched in , along with the Planck mission, and was operational and sending data until its completion in . Herschel was a European Space Agency (ESA) mission, in partnership with the CSA. Herschel was equipped with the largest space telescope ever flown and had three science instruments to analyze infrared and submillimetre radiation coming from outer regions of the universe. The three instruments were the Heterodyne Instrument for the Far Infrared (HIFI), the Spectral and Photometric Imaging Receiver (SPIRE), and the Photometric Array Camera and Spectrometer (PACS). The CSA contributed to two instruments for the mission: HIFI and SPIRE. HIFI enabled a better understanding of interstellar chemistry and detected and analyzed emissions from different molecules; SPIRE explored galaxy structure formation and studied the earliest stages of star formation.

- ASTROSAT – UVIT

-

ASTROSAT mission project was signed in between the CSA and the Indian Space Research Organisation. The mission is operational and as been sending data since its successful launch in . ASTROSAT is planned to be operational until . The mission objective was to study astronomical objects using ultraviolet light and X-rays. Participation in this mission means Canadian scientists are allocated observation time on the satellite, which enables them to conduct unique astronomy research. Canada's participation in ASTROSAT was funded by the CSA and the National Research Council Canada (NRC). ASTROSAT carries five instruments: Ultraviolet Imaging Telescopes (UVIT), Large Area Xenon Proportional Counters (LAXPC), Soft X-ray Telescope (SXT), Cadmium-Zinc-Telluride coded mask imager (CZTI), and Scanning Sky Monitor (SSM). The CSA provided UVIT detectors read-out electronics and calibrations. The detectors capture each photon of light and record its location and time of arrival.

- MSL – APXS

-

The Mars Science Lab (MSL) mission was launched in , landed on Mars in , and is still operational. MSL is led by NASA, with the objective of exploring Mars's surface with the Curiosity rover. It investigates the climate and the geology of Mars. MSL carries 13 instruments in total. Its equipment includes the following.

- Three cameras: Mast Camera (Mastcam), Mars Hand Lens Imager (MAHLI) and Mars Descent Imager (MARDI)

- Four spectrometers: Alpha Particle X-Ray Spectrometer (APXS), Chemistry & Camera (ChemCam), Chemistry &Mineralogy X-Ray Diffraction/X-Ray Fluorescence Instrument (CheMin) and Sample Analysis at Mars (SAM) Instrument Suite

- Two radiation detectors: Radiation Assessment Detector (RAD) and Dynamic Albedo of Neutrons (DAN)

The remaining two instruments are the Rover Environmental Monitoring Station (REMS) and the Mars Science Laboratory Entry Descent and Landing Instrument (MEDLI). The CSA contributed to MSL by providing the APXS instrument, which analyzes samples to determine their chemical compositions, and by supporting the research activities of three participating scientists.

- OSIRIS-REx – OLA

-

The OSIRIS-REx mission, carried out by NASA, was launched in . It is currently on its way to the target asteroid, Bennu. OSIRIS-REx will reach Bennu in , and spend approximately two years mapping the asteroid and searching for an appropriate sample site. The collected sample will then be returned to Earth in for subsequent investigation. OSIRIS-REx carries a total of five instruments: OSIRIS-REx Camera Suite (OCAMS), OSIRIS-REx Laser Altimeter (OLA), OSIRIS-REx Thermal Emission Spectrometer (OTES), OSIRIS-REx Visible and Infrared Spectrometer (OVIRIS), and Regolith X-ray Imaging Spectrometer (REXIS). Canada contributed to the mission by providing the OLA instrument and supporting the investigation's four additional scientists. OLA will scan Bennu's entire surface to create a 3D topographic model of the asteroid in order to set the geological context and to help select a safe sampling site.

- JWST – NIRISS

-

The JWST mission is currently in its development phase. Its planned launch date is -. JWST is expected to be the most powerful space observatory for at least a decade after its launch. The goals of the mission are to search and map the evolution of the earliest stars and galaxies and their formations, and search to see if there is potential for other life in the universe. JWST has four science instruments: Near-Infrared Camera (NIRCam), Near-Infrared Spectrograph (NIRSpec), Mid-Infrared Instrument (MIRI), and Near-InfraRed Imager and Slitless Spectrograph (NIRISS). The CSA contributed the NIRISS instrument, which will investigate first light detection, exoplanet detection and exoplanet transit spectroscopy.

Canadian spacecraft and subsystems:

- JWST – FGS

-

In addition to the NIRISS science instrument, the CSA contributed a mission-critical subsystem for the JWST. The Fine Guidance Sensor (FGS) is a tunable camera that enables the telescope to be aimed at its target very precisely. It is considered the highest precision star guidance system ever built for a space telescope application and will make it possible for JWST to obtain high-quality images.

- MOST

-

The CSA's MOST mission was not only Canada's first Canadian-led space astronomy mission, it was the world's first astronomical space telescope on a micro-satellite. By measuring very precise oscillations in intensity of the stars it determined their ages and composition. It was also used to observe transiting exoplanets. MOST was launched in , and funded by the CSA until . After that, it was sold to a privately owned company which has continued its operation, making it available for use by science customers for a fee. This move represents the first time a Canadian space science mission was privatized.

- NEOSSat

-

The NEOSSat micro-satellite mission was approved in , and sponsored by the CSA and Defence Research and Development Canada. The mission development phase started in , and the satellite was launched in . The satellite has been commissioned and has faced several issues. It is now operational but does not fully meet the original requirements for the space astronomy component of its mission. The goal of the mission is to acquire useful metric data on near-Earth asteroids, assess potentially hazardous asteroids and comets. The contribution of NEOSSat to both Canada and the world is to provide information targeting on the population of near- Earth and potentially hazardous objects.

- ASTRO-H – CAMS

-

The ASTRO-H mission project started in . The mission was in development phase from to . ASTRO-H was launched in ; however, two months after the launch, the mission lost communications with the control base in Japan. Canada's contribution to the ASTRO-H mission began with helping towards the design of the Hard X-Ray telescope. In , JAXA asked the CSA to contribute an optical measurement system for the Hard X-Ray telescope. The CSA built the Canadian ASTRO-H Metrology System (CAMS) and delivered it to JAXA in . CAMS was designed to enable the mission operators to calibrate the data from the Hard X-Ray telescope and thus improve the quality of the images. The ASTRO-H mission was supported by the Government of Canada to ensure that Canadian astronomers continued to play a significant role in international astronomy. The mission objectives were to study the structure black holes, active galaxies, and other cosmic phenomena in extreme conditions.

4.2.2 Immediate outcomes

Evaluation question #8 (Effectiveness): Is there sustained access to scientific data?

Finding #8: Canadian instruments on space astronomy and planetary missions have transmitted a constant stream of observations and images of various types and quality over the years. Calibrated data must in principle be made accessible in public archives within six (6) months for use by all researchers. Principal Investigator/science team involvement in the instrument design and/or post-operation phases has not always been supported due to a lack of grant funding, which adversely affects data quality, data reduction and analysis, and limits the science teams' contribution to the knowledge outcome.

The – Departmental Performance Report on sub-programs and sub-sub programs states that five (5) space astronomy and planetary missions provided data to the Canadian scientific community, surpassing the set target of four (4) missions. Based on additional internal document review, as summarized in Figure 1, and the accompanying mission descriptions, the following space astronomy missions and their scientific instruments were in operation and transmitting data during the evaluation time frame: Herschel (HIFI, SPIRE), Planck (HFI, LFI), MOST and NEOSSat. On the planetary missions side, the APXS instrument has been the most consistent and productive provider of scientific data with the Canadian contribution of the APXS to the MSL Curiosity rover. These missions and their scientific instruments produced a variety of data types, including infrared, optical, X-ray and metric data, for unique research study purposes. Data quality has been an issue for NEOSSat since its launch, and testing continues to determine how the satellite can produce useful scientific data.Footnote 41

The movement towards open data has increasingly gained momentum in space science. For example, NASA requires principal investigators (PIs) to ensure that all transmitted data are calibrated and archived within six months of the download date. In principle, this has broadened public access to the scientific data and given non-mission-related scientists with the appropriate software platforms and tools the opportunity to conduct their own research.

While the closure of mission operations signals the end of the data collection phase, pre-and post-operations support for data requirements definition, instrumentation, data reduction and analysis are equally as important. The NASA program provides end-to-end funding for scientific investigations into instrument design, software development, data reduction and returned sample analysis. Based on the interview data, NASA's competitive tendering criteria require mission contribution proposals to include funding for these scientific activities. This evaluation noted that the Herschel and Planck missions ended in , that CSA support for post-operations data reduction and analysis was extended to , and that the CSA provided grant funding for the development of data analysis software for the Planck HFI/LFI instruments. However, according to the interview data, the principle of end-to-end funding for science team participation in SAM & PM missions has been unevenly applied.

The evaluation's two case studies documented the important role played by the PIs responsible for the science instruments in the success of the MSL and JWST missions to date. Close collaboration was critical with space industry partners and CSA staff to ensure that the instrument design met the data requirement parameters as defined by the science team. Early involvement of the science team in defining the mission's science requirements was identified as a key success factor in the interview data, as was an early commitment to grant funding for data analysis by the PI/science team. One of the barriers to science team participation identified in the interview data was as follows:

- The space industry partners' contract budget line item "

science team support

" left ample room for interpretation as to its purpose. What is often unclear is whether the funds are intended to be used when the industry partner requires support, or to be used to support the science team in carrying out its responsibilities?

The availability of grant funding to support PI/science teams during the pre-and post-operations mission phases was considered preferable, enabling them to better guide instrumentation design, develop data analysis software/tools and support post-mission scientific research. At present, they are considered disadvantaged relative to their research colleagues, who are unencumbered by the responsibilities of operating the science instrument and meeting the open access requirements, which leave little time to contribute to the advancement of knowledge.

Evaluation question #9 (Effectiveness): Have the number of HQP been increased?

Finding #9: The number of faculty and students that have either received funding or were employed on mission-related contracts has fluctuated over the evaluation time frame given the irregular cadence of scientific investigations and missions. The SAM targets of 40 faculty and 30 students were surpassed, while the PM targets of 60 faculty and 50 students were not reached.

The CSA Annual Survey of the Canadian Space Sector has tracked the number of highly qualified personnel (HQP) by Canadian region relative to the national workforce since ; "HQP measurement consists of tracking the number of employed engineers, scientists and technicians in the Canadian space sector.