Comprehensive Socio-Economic Impact Assessment of the Canadian Space Sector

By Euroconsult for the Canadian Space Agency

Final Report

March 27th, 2015

Contact details

Project manager: Adam Keith, Managing Director

Adresse: 465 rue McGill, Suite 1103, Montréal, Québec, H2Y 2H1

Telephone: (514) 750-9707 (direct)

(514) 291-3298 (cell.)

Email: keith@euroconsult-na.com

Table of content

- Executive summary

- Introduction

- The global space sector

- The Canadian space sector

- The economic footprint of the Candian space sector

- The strategic and social value of the Canadian space sector

- Conclusions

- Acronyms

- List of interviews

- Methodology note

- References

Case studies

- Case study #1 The Alberta energy regulator

- Case study #2 Space solutions for the energy and mining sectors

- Case study #3 ABB Canada's space activities and related benefits

- Case study #4 Neptec Technologies spin-off

- Case study #5 Canadian contribution to the NASA Phoenix mission

- Case study #6 Operation Driftnet

- Case study #7 A day without space in the North

- Case study #8 Lac Megantic

- Case study #9 Long duration space mission with Chris Hadfield (2012)

- Case study #10 Canadian participation to Argentina's SAC-D/Acquarius mission

- Case study #11 Polar view

Figures

- Figure 1: World government space expenditures

- Figure 2: 3 Decades government civil space expenditures in the world

- Figure 3: The space value chain

- Figure 4: World's industry revenues from space activities in 2013

- Figure 5: World satellites launched by type of operator (2004-2023)

- Figure 6: World satellites launched by applications

- Figure 7: Government funding and market shares in satellite communications (2004-2013)

- Figure 8: The 3 value chains of commercial satellite markets in 2013

- Figure 9: Government's approach to space (2014)

- Figure 10: Canada civil space budget

- Figure 11: Canada civil space spending, breakdown by application 2009-2014

- Figure 12: Share of Canadian government civil space investment in world's total

- Figure 13: Budget comparision of Canada with the top world 10 space programs

- Figure 14: The Canadian space sector value chain in 2013 ($ in million)

- Figure 15: Three ways to breakdown the Canadian space value chain

- Figure 16: Regional distribution Canadian space sector (2013)

- Figure 17: Distributions of companies by revenues

- Figure 18: Key revenue trends (2004-2013 CAGR)

- Figure 19: Revenue trends of the Canadian space sector

- Figure 20: Canadian space sector's total contribution to GDP (2013)

- Figure 21: Revenues vs. direct GDP contribution (2013)

- Figure 22: Canadian space sector's total job creation (2013)

- Figure 23 : Evolution of space sector vs. Canada employment (2008-2013)

- Figure 24: Canadian space sector direct employment breakdown (2013)

- Figure 25: Labour productivity of Canadian space sector

- Figure 26: Mapping of private sector and government department end users

- Figure 27: Canadian government earth observation data usage

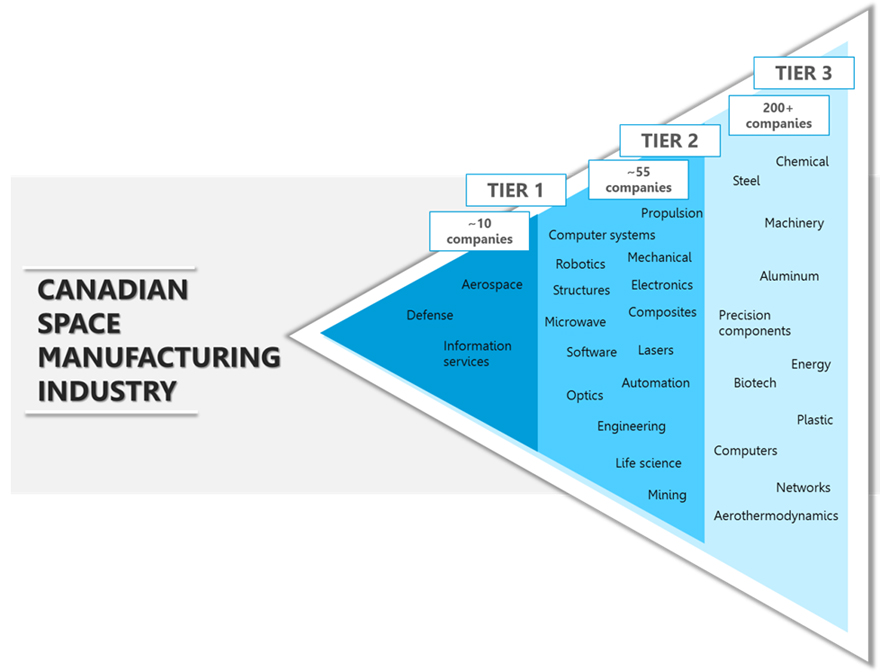

- Figure 28: The Canadian space manufacturing industry and its connected sectors

- Figure 29: Part of budget allocated to technology transfer activities

- Figure 30: R&D expenditures by the Canadian space sector (2013)

- Figure 31: Space related scientific publications in three select disciplines published in Canada (2003-2012)

- Figure 32: Overview of DND main dedicated military space based infrastructure

- Figure 33: Major Canadian Armed Forces deployment abroad

- Figure 34: Canadian subscribers to satellite TV services (1995-2013)

- Figure 35: Canadian subscribers to satellite internet broadband services (2004-2013)

- Figure 36: Educational initiatives focused on young Canadians

- Figure 37: Social media activity of CSA and other agencies

- Figure 38: Distribution of agreements by application domain (1990-2014)

Tables

- Table 1: Top 10 space program funding worldwide

- Table 2: World government space expenditures by applications (2004-2023)

- Table 3: Key trends in satellite service markets

- Table 4: A selection of major current Canadian government space projects

- Table 5: Small and medium enterprise (SME) in the Canadian space sector (2013)

- Table 6: Space markets trends and Canadian market share

- Table 7: Overview of Canadian space sector's direct, indirect and induced impacts (2013)

- Table 8: Key federal government users of satellite-based services

- Table 9: A range of business users and applications

- Table 10: Two Canadian space players and their suppliers

- Table 11: New terrestrial applications developed through the CSA AETDP program (sample)

- Table 12: Spillover effects from CSA contracts surveyed (2005-2014)

- Table 13: Canadian space related research facilities and disciplines covered

- Table 14: A selection of space based solutions to climate change issues in Canada

- Table 15: A selection of space based solutions

- Table 16: Foreign vs. Canadian led projects in cooperation missions (1990-2014)

Executive summary

The Canadian space sector and its environment

The world context for space activities is changing

The international space sector is experiencing profound change. Countries with historical leadership in space have been under pressure as a result of a tough financial environment leading to the redefinition of their priorities. In the meantime, new leaders such as China and India have affirmed their ambitions in space through massive investments in the development of their capabilities, while a flourishing number of countries now invest in space, shaking up the international hierarchy.

Changes are no less significant in the market environment of the space industry that faces significant evolution along its value chain, from upstream to downstream. Space industry players worldwide have to rethink their business models and strategies as they experience disruptive innovations, a tougher competitive environment and new drivers impacting the manufacturing, launch and services businesses.

Canada: A pioneer in space looking for new ambitions

Canada realized early on the benefits it could derive from the development and use of space technology. Since the launch of Alouette more than 60 years ago its space sector has pioneered the development and application of advanced space technologies:

- Canada was the first country to operate a commercial domestic communications satellite (Anik) from geostationary orbit in 1972, to deploy a direct-to-home broadcasting service in 1978 and to introduce two-way broadband internet across the country in 2004.

- Canada pioneered operational Synthetic Aperture Radar satellites with the RADARSAT series, the third generation currently under development.

- Canada established itself as a world leader in space-based robotic technologies and vision systems with the iconic Canadarm program.

Recently however, Canada has lost its place in the group of the world's leading space programs. Over the years, Canada's investment in its space program has seen a downward trajectory with the Canadian Space Agency's baseline budget now under $300 million, which is below to that of 1999. Despite some additional targeted allocations or acquisition programs, this lower funding level challenges the ability of the country to grow its technological capability in space.

The adoption of the national Space Policy Framework in 2014 provides long-term guidance that is critical for all Canadian stakeholders. It also reinforces the strategic character of space activities for the country by reaffirming the alignment of the national space program with government's strategic priorities.

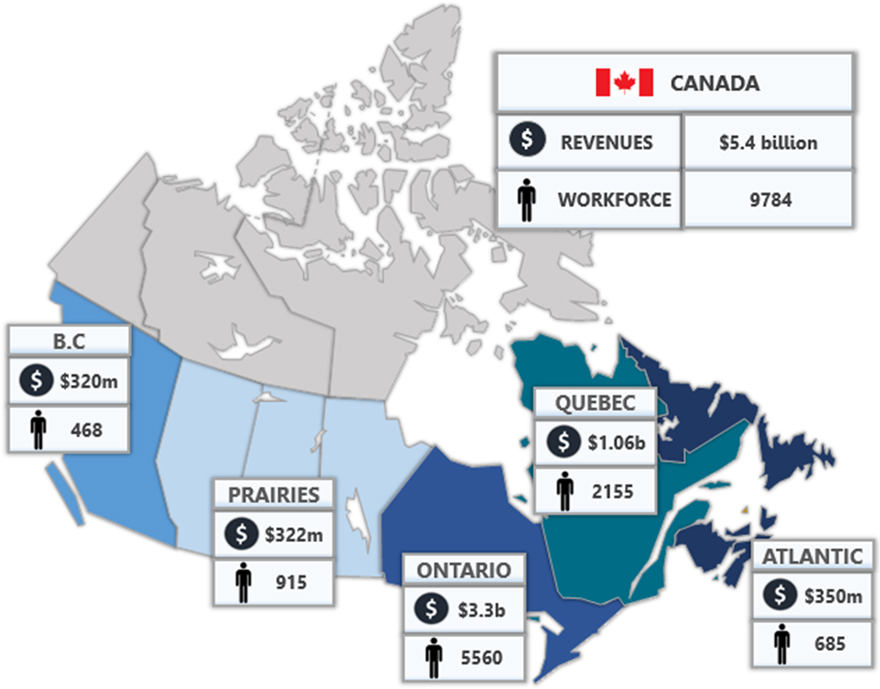

200 active organizations generating $5.4 billion in revenues

The Canadian space sector is comprised of over 200 organizations involved at different levels of the space value chain and employing a total of 9,784 workers involved in a wide array of highly qualified jobs. It is estimated that this sector generated cumulative revenues of $5.37 billion in 2013 when taking into account Canadian satellite broadcasting activities, and $2.63 billion when excluding these activities.

Prominent aspects of the Canadian space sector include:

- Revenues growing at a rate superior to that of the Canadian economy (3.7% on average during the last five years compared to 1.8%), driven by a dynamic downstream sector.

- Revenues are concentrated with the 10 largest firms accounting for almost 90% of the industry's total.

- SMEs account for nearly 90% of all organizations, but with small space-related revenues.

- The downstream (service) sector generates 79% of the revenues and posts the highest growth.

- Satellite communications, commercial and export markets represent key drivers.

- Ontario and Quebec together account for approximately 80% of sector revenues and employment.

Share of Canadian firms in the world space markets

The global space industry generated revenues estimated at US$250 billion in 2013, of which 80% was for commercial activities (essentially derived from services, in particular satellite television) and 20% for government activities (essentially derived from manufacturing activities). The share of the Canadian space industry in the world market is estimated at nearly 2% which is a good performance when considering that Canada accounts for less than 1% of the world's total funding for civil space activities.

It should be noted that the Canadian industry records its highest market share in the commercial satellite manufacturing market (for telecommunications). However, eroding R&D investments in the national space program challenge the position of Canadian companies in a tough, globally competitive market.

The economic impact of the Canadian space sector

Canadian space sector's direct, indirect and induced benefits

The Canadian space sector's overall contribution to Canada's GDP represents the value-added of the industry for the national economy (it is therefore different from the sector's revenues). Taking into account its direct, indirect and induced effects, the Canadian space sector generated in 2013:

- An economic multiplier of 1.85 (ratio of direct GDP contribution to indirect and induced contribution) with a total GDP contribution of $2.9 billion.

- An employment multiplier of 2.5, with 24,354 full-time equivalent jobs.

- $750 million of tax revenues to federal, provincial and municipal governments.

While methodologies for calculating economic benefits can diverge between studies, it was found that the Canadian space sector's multipliers are equivalent, if not superior to other Canadian industries (such as aviation) and other countries' space sector (such as the UK).

Other important outcomes from the study regarding the Canadian space sector's economic impact include:

- Services and manufacturing are the biggest contributors to its GDP impact accounting respectively for 55% and 30%.

- 45% of its direct GDP impact is made by SMEs.

- The sector has grown nearly six times faster than Canada's national job market.

- The sector is a magnet for highly-qualified personnel (engineers, scientists and technicians), who accounted for 53% of its workforce.

- With a GDP per worker of roughly $160,000, its workforce was over twice as productive as Canada's broader industrial workforce.

The space sector diffuses wider effects on Canada's national economy

The Canadian space sector produces wider effects on the national economy as it boosts innovation, knowledge and productivity from suppliers to end-users.

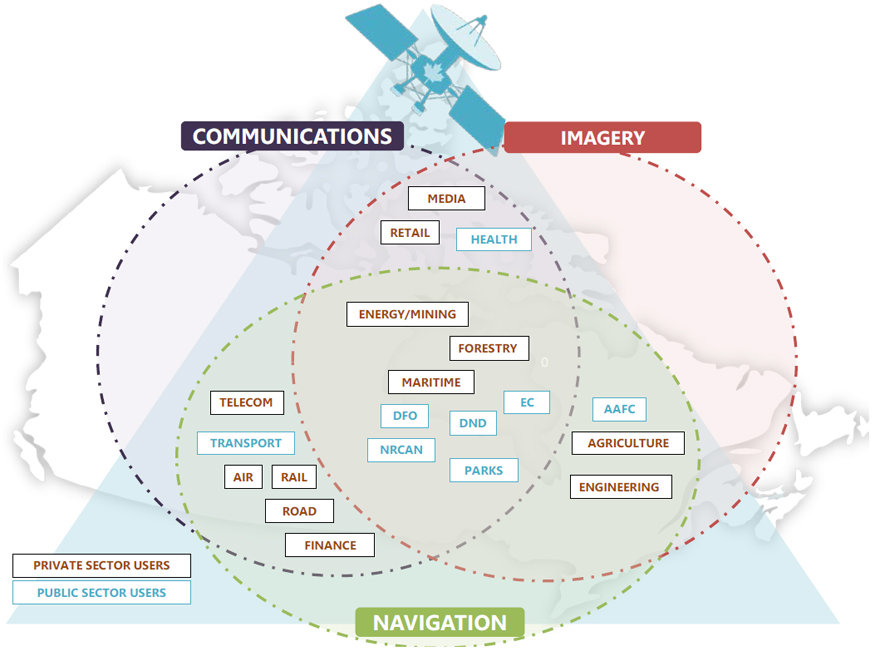

Over one thousand Canadian public and private organizations coming from multiple sectors are active users of space-based solutions. Canada's top business users include such sectors as energy, agriculture, forestry, engineering/infrastructure, retail, finance, media, telecom and transportation. They rely on space to enable, secure or improve their business operations by monitoring remote or inaccessible regions, collecting key information for their decision making, or ensuring connectivity across their networks. As such, space represents a key enabler to generate cost savings and efficiency gains.

The space sector also fosters the creation and the diffusion of knowledge and innovation in the Canadian industry, research and scientific communities:

- It invested roughly $180 million in R&D in 2013, which corresponds to an R&D intensity of 11% of the sectors' GDP impact, much higher than any other major national industry.

- For each dollar invested through Canadian Space Agency contracts, another $1.2 is created in spill-overs benefits to the economy beyond the value of the initial contract value.

- Close to 50 Canadian research institutions and universities are engaged in space-related academic programs in the science, engineering, policy and legal fields.

- Canadian researchers in space-related disciplines issued 2,507 publications accounting for 6.9% of the world's total, i.e. part of world's best performance.

The space sector relies on a wide range of technologies, equipment and products, implying technology transfers with other industries. On the one hand, space is a strong vector for suppliers to improve their product quality, implement world-class standards, stimulate engineering teams and showcase their capabilities. On the other hand, the cost of technology adaptation and the lack of long term business predictability from government contracts can make space business unsustainable for the smallest companies. Such constraints have already pushed several Canadian companies to reduce or even cease their space operations.

The strategic and social value of the Canadian space sector

Support Canada's security and sovereignty

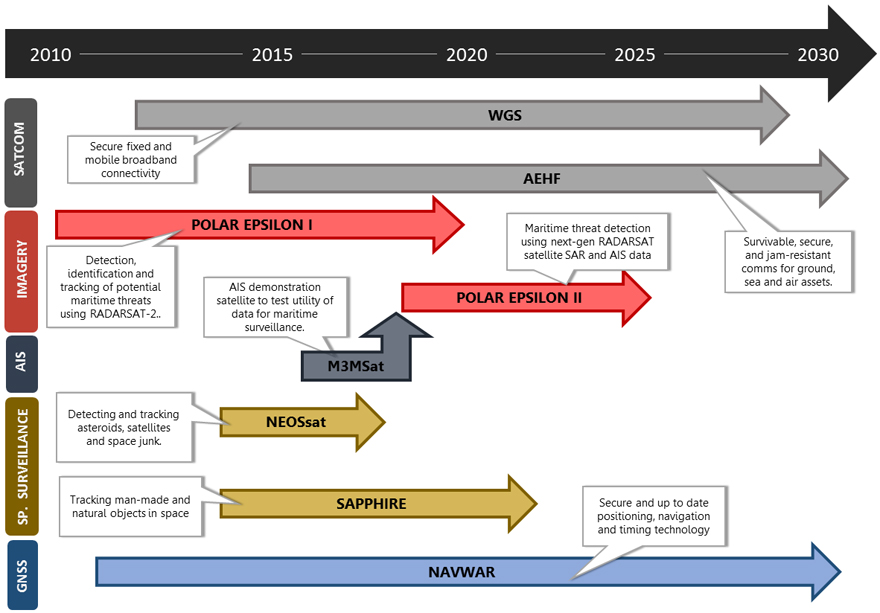

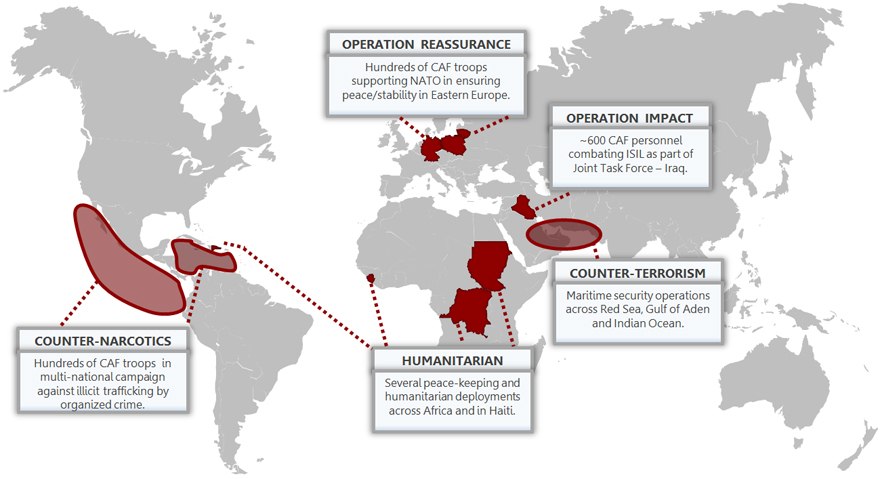

Today the Canadian defence and security community is a mature operational user of space-based solutions. The Department of National Defence (DND) has engaged in an ambitious plan to acquire and develop space-based capabilities. This includes domestic assets such as Polar Epsilon/RADARSAT-2 (Earth observation), M3MSAT (Automatic Identification System), NEOSsat and Sapphire (space surveillance). It also includes cooperation programs with allied countries such as with the U.S. DoD for satellite communications. These space-based assets are considered to be critical for DND to undertake its missions, including:

- Maritime domain awareness: To monitor illegal criminal activity, track ships, enforce laws and regulations, protect against severe weather, search and rescue, etc.

- Arctic sovereignty: Space-based assets are the only reliable solution to provide communications, positioning and intelligence over the Arctic.

- International operations: The 1,500 Canadian military personnel deployed around the world rely on satellites to conduct their operations.

Space is part of Canadians' everyday life

The space sector has grown to be increasingly prevalent in the everyday lives of Canadians:

- Space plays an essential role in improving Canadians' quality of life through accurate weather information delivered by Meteorology Services Canada, or the usage of GPS along over one million kilometers of Canadian roads.

- Space supports the distribution of more than 1,200 TV channels to 2.7 million households. It has been part of the backbone of the national television network since its early days.

- Space contributes to help bridge the digital divide where terrestrial networks cannot be implemented or are at a prohibitive cost. 200,000 national households rely on satellite for internet access, making Canada the second largest market in the world. Satellite is a primary, and sometimes the only, source of connectivity, such as in the North where it provides vital social and economic links with the rest of country and the world.

- Space plays a pivotal role in supporting the populations' safety: The COSPAS-SARSAT system, headquartered in Montreal, has aided in the rescue of 1,500 Canadians since its inception in 1982. The Coast Guard also employs space-based solutions while responding to maritime distress situations, helping save 2,200 Canadian lives each year.

- Space is also a source of inspiration: the Canadarm and Canadian astronaut program have inspired generations of Canadians. With over 200,000 YouTube subscribers and 5 million annual visitors to its website, the CSA performs at a level equivalent to that of top national associations and agencies.

Space helps protect and manage our environment

Space solutions have unique advantages for both climate change monitoring and natural resource management, helping governments and private enterprise protect and manage our environment. Satellite data provides essential information to multiple sectors (including agriculture, forestry and oil and gas), generating benefits such as assessments of crop health and yield, improving security through monitoring of expansive territory and identifying pollutants in the lakes and oceans.

The importance of monitoring climate variables in Canada is vital considering the size of the Canadian land mass (over 10 million Km²), the extent of its ocean borders (244,000 km, the longest in the world) and its significance as a host for extensive forested and ecologically sensitive areas. Data collected over Canada further serves as an input in global environment monitoring. Leveraging its space-based assets, Canada can monitor global climate change as well as phenomena over Canadian territory.

Canada is a resource-rich country: The energy and mining sectors contributed over $170 billion to Canada's GDP in 2013 (over a quarter of the value of the goods-producing economy), its agriculture and agri-food sector generated $103.5 billion, its forest sector $57.8 billion. In addition, Canada has the third highest reserve of drinkable water in the world. Space-based data is used across government and private sectors to manage and monitor those resources, as well as to ensure efficient and secure business practices. This is key for Canada's economy and resource sustainability.

Space fosters international collaboration

Canada has been able to augment its national program through broad collaboration with international partners. Since its inception, the Canadian Space Agency has signed close to 200 bilateral and multilateral agreements with over 24 international partners, including 78 agreements with NASA. Through international cooperation, Canada generates multiple benefits such as participating in projects it could not afford on its own, accessing critical information and data from other nations' satellites, meeting its international obligations or exporting technology and expertise.

The development of new capabilities through international partnerships helps Canadian companies boost visibility in the global market. For example, Canada enjoys a specific position within the European Space Agency as a Cooperating State since 1979. Canada receives substantial benefits for this investment that enables its industry to participate in large-scale international and R&D programs, further creating significant strategic and business opportunities.

Conclusions: Opportunties and challenges for the Canadian space sector

The development of leading-edge capabilities from selective investments has been a priority of the national space program. Over the years, Canadian suppliers have developed world-class expertise in areas such as robotics, sensors, scientific instruments and telecommunications payloads. In many aspects the Canadian space sector has reached a relative level of stability with a regular revenue base and a dynamic downstream sector thanks to investments made upstream in space technology. This vitality diffuses benefits across Canada with multiple economic, strategic and social impacts across the nation.

However, this report has highlighted several factors that affect the impact of the Canadian space sector for the country. The following are considered the most critical::

- As the global context for space activities is rapidly changing and Canadian investment in its space technological capabilities decreases, its position on the international scene is challenged. Although a G7 country, Canada dedicates much less of its GDP to its civil space activities than the world average. Its baseline funding will likely not enable Canada to maintain its space capabilities in the long term. In addition, budget instability and unpredictability affects the most fragile players, especially SMEs that form a critical part the Canadian space sector's ecosystem.

- When taking into account defence, the Canadian government's total investment in space has actually increased quite significantly. However, the return of these investments remains limited for the Canadian space sector as a large part is spent on foreign programs. Considering the scale of the investments, this is a non-negligible shortfall for the Canadian space sector.

- Canadian government investment in space has not always supported domains showing high market potential, limiting the possibility to turn this initial investment into larger economic gains for the space sector. As result, several industry players have been progressively pushed away from the Canadian space program. In addition, this situation fosters at the same time dependency for a segment of the industry on government-specific requirements and cycles of decisions and investments.

- Many successful companies focus on the export market which can represent up to 90% of their revenues, with little dependency on government R&D or support programs. While a sign of commercial maturity, in the longer term it could create a risk for business sustainability and key technological capabilities and furthermore cause a disconnect between industry technological capabilities and government national requirements.

- The Canadian industry has made significant investments outside Canada, including foreign acquisitions and the implementation of facilities in other countries. While it shows the dynamism of the largest Canadian companies, they choose to invest outside Canada to grow their business. Conversely, Canada does not attract enough foreign investment in its space sector, whereas this would provide additional capital and grow its technology base.

- Outside a few large programs, Canada offers limited opportunities to undertake programs in partnership between the public and the private sectors. Whether for R&D or the delivery of operational services, large to small scale projects, many countries have implemented a larger portfolio of cooperation schemes allowing the flexible implementation of programs and expanding funding sources.

- Finally, only a healthy indigenous space industry can generate the benefits that Canada can expect to accrue in the future from its space investments and, more generally from space activities whether these activities are based on Canadian or foreign space assets.

This report does not aim to formulate recommendations, but several elements could be considered to increase the impact of the Canadian space sector, including:

- The review of mechanisms used in other sectors or in other countries, and the assessment of their implementation in Canada. Whether for investment strategies, partnerships, co-funding mechanisms, technology transfers, regulations, support to start-ups or SMEs, interesting lessons learned could be collected and shared from their experience.

- Based on the 2014 Space Policy Framework, the definition of a national strategy for space technology and industry associating all components of the Canadian space program (civil and defence, industry and scientific communities). Such a national strategy, outlining a long-term action plan related to strategic capabilities, would be key to ensuring the sustainable long-term impact of the national space sector for Canada.

Text version of Socio-economic impact of the Canadian space sector image

Socio-economic impact of the Canadian space sector

The infographic presented is a series of boxes with small visual characteristics to define each segment of the economy or society being referenced.

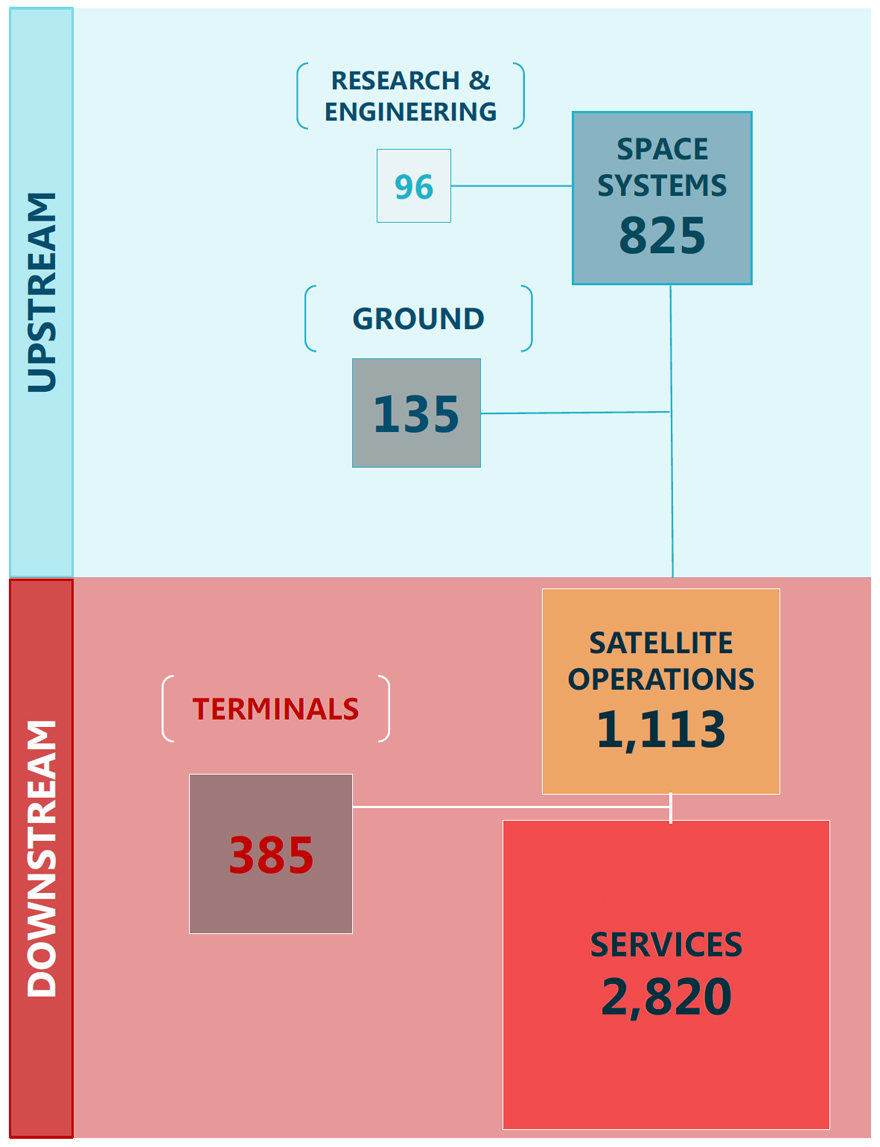

The first graphic is a series of blocks regarding the general impact of Canada's Space Sector. Canada generates $5.4 billion in revenues from the Space Sector. The Upstream Sector generates $1.1 billion, and specializes in Space Systems ($825 million), Ground Systems ($135 million), and Research and Engineering ($96 million). The Downstream Sector produces $4.3 billion in revenues, and is concentrated in Consumer Services ($2.820 billion), Satellite Operations ($1.113 billion), and Terminals Systems ($385 million).

The next graphic is a small building with some statistics to the side. There are 226 organizations involved in the Space Sector, of which 200 are Small to Medium Enterprises (SMEs). The 10 largest firms account for approximately 90% of the revenue.

The following graphic is an outline of a person with some statistics to the side. A large number of personnel in the field are highly qualified (53%), creating $160,000 in GDP per professional, which is twice the national average. Job creation in the Space Sector is six times faster than the national rate.

A graphic that displays a trending upwards arrow represents the CAGR. The Compound Annual Growth Rate for the Space Sector is 3.6% over 5 years, which is double Canada's economy at 1.8%.

Three blocks overlaying a map of the world list the influence that Canada has on the world stage. Canada's status in the Space Sector is represented by 24 international government partners, accounting for 2% of the world industry market share, and represents 1% of all civil space funding.

Next, a small graphic displays the GDP, Jobs, and Tax benefits accrued to the Canadian economy through a series of stated facts encircled by their corresponding direct, indirect, and induced characteristics. The economic footprint of the Space Economy is 24,354 jobs, $2.9 billion in GDP, and approximately $750 million in tax revenues from direct, indirect, and induced investment.

Another graphic representation of computers, televisions, satellites, etc. matches corresponding facts listed to the side. The descriptions follow: Space impacts everyday lives by bringing 1,200 satellite channels, 2.7 million TV subscribers, 40 million location based services via GPS, 50%of arctic households connected by satellite, and 200,000 satellite internet access subscribers. Furthermore, the online community for the CSA is represented by 152,000 Twitter followers, a Youtube channel of 220,000 subscribers, and 88 videos, millions of viewers and live events on the ISS by Canadian astronaut Chris Hadfield.

Finally, a graphic of various industries is presented with visual representations for each segment and a dollar figure attached to display its influence. The information follows: Space is critical for research and development (R&D; $180 million), military personnel conducting operations (1,500 people), tracking ships in Canadian waters (4,000 every day), and passengers travelling through Canada's airports (120 million a year). Additional benefits include Canadian lives saved every year through space related assistance (2,200 people), operations that support the energy sector ($170 billion dollar industry), precision agriculture for Canadian farming operations (205,730 beneficiaries), and the management of Canadian freshwaters and land (10 million square kilometers).

Introduction

In moving forward with the implementation of Canada's Space Policy Framework, unveiled in February 2014 by Industry Minister the Honourable James Moore, the Canadian Space Agency (CSA) is undertaking a series of studies to support the development of a "Value Proposition for Space" aimed at demonstrating how space investments contribute to Canada's economic growth and job creation. The Value Proposition will support informed decision-making for future policies and investments in the space sector.

In this context, the present comprehensive socio-economic impact assessment of the Canadian Space Sector study has for objective to capture the macro-economic level of space sector impact and to enhance the knowledge of the direct, indirect and induced benefits resulting from space activities in Canada, whether public or private.

This study has been completed on the basis of multiple sources of information, including:

- An extensive review of socio-economic studies performed in the space sector and other sectors in Canada and worldwide.

- Desk research to collect information required to perform the analysis. Particular attention was brought to other studies or activities performed by the CSA or other government departments with information of interest for the purpose of this study.

- Consultation with actors from the Canadian Space Sector and government departments, which enabled us to obtain primary data and direct information from stakeholders. 43 interviews were conducted. A detailed list is provided in Annex.

- A review of information available in-house from Euroconsult's most recent research activities.

This report is structured into five distinct sections:

- The Global Space Sector, which reviews the worldwide context for government and commercial space activities;

- The Canadian Space Sector, which reviews the Canadian specific context for government and commercial space activities;

- The Canadian Space Sector's economic footprint, which encapsulates in quantitative and qualitative terms the impacts of the space sector on Canada's economy from suppliers to end-users;

- The Canadian Space Sector strategic and social value, which reviews the wider benefits generated by the Canadian Space Sector to Canada for its security and sovereignty, its population, its environment and its position on the international scene.

- Conclusions

The global space sector

1. Government space activities worldwide

1.1 Global context in transition

Governments' actions are critical for the space industry through 1) their investment in R&D in a technology complex sector, and 2) the creation a favorable policy and regulatory environment for the emergence and development of space-based applications and services. After two decades of continuous growth, global government investments in space have stagnated since 2010. With US$72 billion spent worldwide, 2013 marked the first time investments in annual expenditures decreased since 1995. With close to US$44 billion, civil programs account for 61% of global funding for space, a growing share since 2009. Military expenditures have dropped by 15% since 2010 as a result of massive reductions in the U.S. following a decade of nonstop increases. This pressure on public finances, notably in North America and in Europe, has seriously affected governments' ability to support their national space programs, with direct impacts on the civil and defence agencies running these programs and the industry contractors executing them.

Figure 1: World government space expenditures (US$ in billion)

| 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| World | 30.18 | 28.21 | 29.15 | 32.84 | 34.53 | 36.14 | 36.74 | 37.23 | 40.39 | 43.74 | 47.34 | 50.39 | 53.23 | 58.32 | 63.53 | 69.67 | 71.30 | 71.47 | 72.91 |

| Defense | 9.6 | 7.4 | 8.2 | 12.6 | 13.4 | 14.6 | 15.5 | 15.9 | 17.7 | 19.6 | 21.7 | 23.2 | 24.5 | 27.6 | 30.5 | 33.7 | 33.5 | 31.6 | 31.7 |

| Civil | 20.6 | 20.8 | 21.0 | 20.3 | 21.2 | 21.5 | 21.3 | 21.4 | 22.7 | 24.2 | 25.7 | 27.2 | 28.7 | 30.7 | 33.0 | 36.0 | 37.8 | 39.9 | 41.2 |

Source: Euroconsult

The international context of space activities has significantly changed in the last 20 years as a flourishing number of countries invest in space around the world: 58 countries had a space program in 2013, compared to 37 in 2003. Such dynamism demonstrates how space technologies and applications are seen by governments as a valuable investment in order to support their national social, economic, strategic, and technological development. These emerging space-faring countries open up new institutional and industry cooperation opportunities for established players, including Canadians, but also new challenges as they look to develop domestic technologies that may ultimately compete with existing players in the international market. Figure 2, on the following pages, shows the growth in space-faring nations over the past three decades.

Figure 2: Three decades government civil space expenditures in the world

(Countries spending over $10 million only)

(Current US$ in million)

Figure 2 - Text version

Figure 2 consists of three separate infographics covering three decades of government civil space expenditures around the world, labelled a, b, and c. The graphics only include countries that spent over 10 million on space related activities.

The first graphic is Figure 2a representing space expenditures in 1990. The image displays a series of bubbles, each representing a country, that are then grouped together and color coded according to their area of operations (North America, Europe, Russia, and Asia). The visualization includes 15 countries involved in space activities, and the size of each country bubble is represented by their space budget in U.S. millions. The United States is by far the biggest spender ($12,460), followed by Russia ($5,232), all of Europe ($4,000), the European Space Agency (ESA) ($2,429), and Japan ($1,124). Many other countries made significant contributions, but Canada was one of the smallest with $222 million U.S. budgeted for space.

Figure 2b follows the same visualized bubble representation, but covers 37 different countries in 2003. Again the United States was the largest investor in space activity ($15,200), followed by Europe ($4,562), the ESA ($3,528), and Japan ($2,257). Russia's contributions significantly declined in this period, investing only $245 million in space related activities. Another area of operations was added as well, with Brazil ($56) and Argentina ($30) beginning investments in space. Many other countries made significant contributions, but Canada was again one of the smallest with $219 million U.S. budgeted for space.

Figure 2c follows the same visualized bubble representation, but covers 58 different countries in 2013. Again the United States was the largest investor in space activity ($19,770), followed by Europe ($8,926), a reinvigorated Russian program ($6,414), the ESA ($4,909), and China ($2,384). Another area of operations was added as well, with numerous African countries beginning investments in space. Many other countries made significant contributions. Canada had average contributions compared to other countries, investing $473 million U.S. budgeted for space. It should however be noted that this may represent a one-time investment, as Canada has had a consistent budget for space activities of $300 million Canadian dollars.

1.2 Trends in national space programs

Public investment for space remains concentrated with the five largest national space programs (U.S., Europe, Russia, Japan and China). This concentration has decreased over time (from 97% in 2004 to 93% of the world's government spending in 2013) but is expected to remain stable in the coming decade. The top 10 programs worldwide have undergone compelling changes with a group of historical players experiencing strong budget pressure (U.S., Europe, Japan) along with those who have affirmed their global leadership in the last decade with a significant investments (Russia, China, India). Besides these top 10 space programs, 18 countries recorded over US$100 million in spending (including Canada) and 30 other countries invested between US$10 million and US$100 million in their national space programs.

| Country/ organizationFootnote 1 |

2013 Funding (US$) / 5Y CAGR | Recent trends |

|---|---|---|

| USA | 38.7B/-3% | Transition period both for civil and military programs. Leadership under pressure. Increasing focus on commercial/international partnerships. |

| Russia | 11B/32% | Historical peak funding resulting from ambitious plan to modernize space-based infrastructure & guarantee national independence |

| China | 4B/15% | Priority towards ambitious plans for manned spaceflight, launcher, navigation and Earth observation activities. Support to export. |

| Japan | 3.3B/3% | Defence drives national investment growth. Space program shifts from technology focus to space utilization and commercialization. |

| France | 2.9B/1% | Stable funding despite budget pressure. National space industry is heavy weighted towards manufacturing and launch which drives national priorities. |

| Germany | 2.1/5% | New leadership in the European space program. Becomes the first European Space Agency (ESA) contributor focusing on capability building and satellite applications. |

| EU | 1.6/40% | A key stakeholder for space in Europe, though challenging completion of Galileo and Copernicus leave ambiguity on future mandate. |

| India | 1.2B/14% | Historically oriented towards civil applications, now also defence and security. A model for space program development in developing countries. |

| Italy | 1.1/3% | Budget situation raises cloud of uncertainty concerning government's ability to respect national program commitments, notably those for ESA. |

| UK | 0.8/6% | Recent decision to boost national space strategy raised UK's position within ESA. History of partnership with private sector and application driven. |

Source: Euroconsult

Trends by key space applications include:

- Manned spaceflight represents the first spending item: $10.9 billion in 2013 driven by the development of next-generation transportation systems and orbital infrastructures. Only seven countries plus ESA invest in such programs. The U.S. accounts for 70% of total funding, but China will account for 25% of spending by 2023.

- Earth observation received $10.7 billion in 2013 driven by civil programs to be undertaken in 62 countries by 2023 generating enormous growth in satellite launches. Funding will gradually drop once large programs pass their investment peak around 2017. Asia will become the top region accounting for 37% of expenditures in 2023.

- The development of next-generation launch vehicles in multiple countries boosts expenditures related to launcher programs (15 countries/agencies, $8.6 billion in 2013). Global funding stability is expected through the decade. Launchers can represent between 15% and 50% of the agencies' budget when such programs are undertaken.

- Satellite communications is estimated at $7.2 billion in 2013, dropping to $5.9 billion by 2023 due to declining military expenditures. Civil programs drive expenditures which is reflected in the growing number of countries investing. 185 communications satellites are expected to be launched of which two thirds will be in Russia and Asia.

- Space science and exploration totalled $5.6 billion in 2013 and is expected to reach $8.3 billion in 2023, driven by ambitious plans in Russia and Asia, and a sustained high level of investment in the U.S. 25 agencies invested in space science and exploration but five countries represent 92% of total spending.

- Satellite navigation reached $4.3 billion with only five countries plus the European Union investing in the development of these systems. Increasing funding is expected to support systems' deployment reaching an all-time high of $5.6 billion in 2020. 124 positioning and navigation satellites are expected over the next decade.

| ApplicationsFootnote 2 | 2004 | 2013 | 2023 | |||

|---|---|---|---|---|---|---|

| # Countries | US$ billion | # Countries | US$ billion | # Countries | US$ billion | |

| Earth observation | 28 | 6.5 | 55 | 10.7 | 62 | 10.8 |

| Satcom | 20 | 3.9 | 48 | 7.2 | 61 | 5.9 |

| Science | 18 | 5.8 | 25 | 5.6 | 28 | 8.5 |

| Launchers | 11 | 2.7 | 15 | 8.6 | 16 | 8.2 |

| Security | 4 | 1.3 | 8 | 2.7 | 11 | 3.2 |

| Satnav | 6 | 1.4 | 9 | 4.3 | 9 | 5.2 |

| Manned spaceflight | 7 | 9.1 | 8 | 10.9 | 8 | 17.6 |

Source: Euroconsult

2. The space industry worldwide

2.1 The space value chain

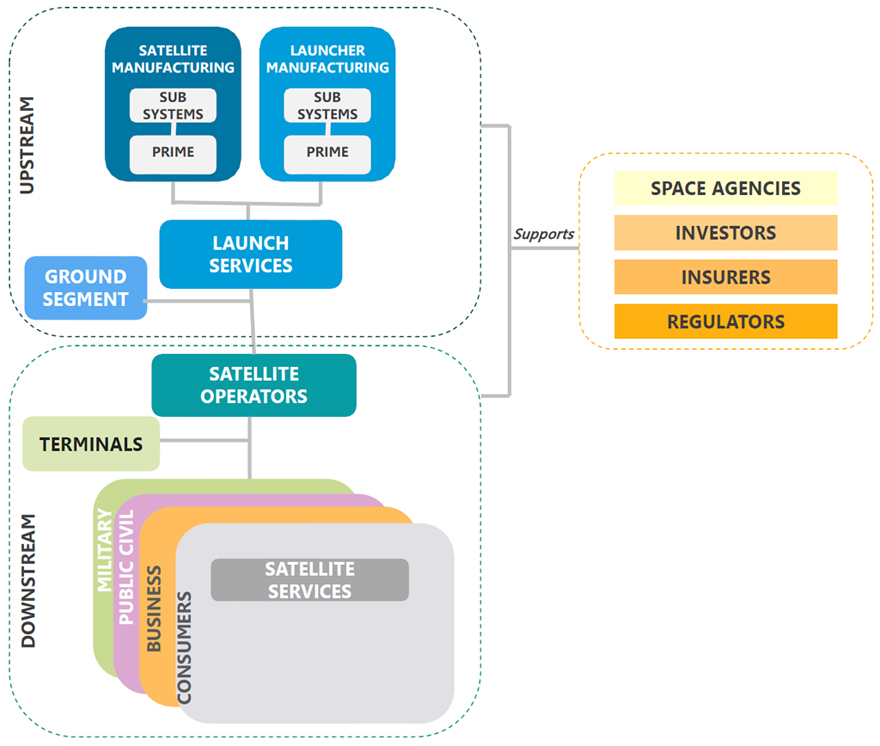

The value chain that allows the delivery of space-based services includes a wide range of stakeholders acting at four different levels:

- Government agencies who fund space technology R&D for their own use and for dual-use purposes

- The upstream space sector that includes a limited number of players who design and manufacture space systems, their launch vehicles and ground infrastructure.

- The downstream space sector that includes:

- The satellite operators who own and operate the satellite systems and market their capacities to the service providers;

- Service providers and terminal suppliers who deliver communications, navigation and geographic information services to end users by integrating the satellite signal into packaged solutions.

- The end users, whether governmental (civil/military) or commercial (business or customer) who do not ask for the satellite technology per se but rather for solutions tailored to their needs, whether for better communications, navigation or geographic information services.

The distinction between the upstream and the downstream segments of the value chain is a moving frontier as stakeholders can be vertically integrated and involved in multiple business segments, from technology development to service provision. Nevertheless, this distinction remains essential in order to understand the structure of the space industry and the business model(s) pursued by its players.

Figure 3 provides an overview of the entire space sector value-chain.

The upstream space sector

The upstream space sector includes a variety of research, engineering, manufacturing and service activities intended to support the development and launch of space systems and capacity.

Research and engineering activities are undertaken by a large number of private companies and public organizations (research centers, universities etc.), from large to very small organizations, that undertake technology innovation for space systems and sub-systems. Governments (through space agencies) and large industry players (such as space systems manufacturers) are critical to fund and support research and engineering activities.

Space system manufacturers design, develop, assemble, integrate and test satellites, spacecraft, other probes, and launch systems, as well as the ground systems that are intended to command and control the space segment. Their objective is to maximize the profitability of their activity while maintaining their technological capabilities. The manufacturing segment is composed of a limited number of Tier 1 (prime) system integrators and their supply chain. The supply chain is composed of a larger number of Tier 2 and 3 companies designing and manufacturing subsystems, parts and components that they deliver to the integrators, either domestically or internationally.

Similar to space systems manufacturing, satellite launching is a low margin activity. This underlines the primary role of public institutions in the development and production phases of the launch vehicles as autonomous access to space is often a strategic priority for space powers. Launch vehicle manufacturers and service providers rely on:

- The long development cycle of a new launch vehicle (up to 15 years) that requires extensive public funding and continuous R&D support

- The ability to put in place efficient industrial processes, with the objective of optimizing the costs, reliability and production rate of the launch systems

Ground systems manufacturers produce a range of equipment needed to receive, process and manage the signals transmitted by spacecraft, as well as track and control the satellite in space. These manufacturers specialize in radio-frequency components and systems, large gateway antennas and network hub systems used by satellite operators, teleports and service providers.

Figure 3 - Text version

The Space Value Chain is broken down into three different segments (Upstream, Downstream, and Space Agencies) represented visually as blocks. Each corresponding block is connected to one another. Inside of each block are the sub-segments which influence its function. The Upstream is composed of Launch Services, which includes a Ground Segment, Satellite Manufacturing (sub systems and prime systems), and Launcher Manufacturing (sub systems and prime systems). The Downstream is composed of Satellite Operators, which make use of Terminals, and provide services to Consumers, Business, Public Civil needs, and Military needs. Both the Upstream and Downstream segments of the value chain are supported by Space Agencies, which act as Investors, Insurers, and Regulators.

The downstream space sector

The downstream space sector includes satellite operations, data or signal distribution, and value-adding activities intended to transform or deliver space capacity into useful services and products for end users.

The visibility of satellite technology decreases down the value chain; it becomes merely a component of an integrated solution ("space inside"). While only part of the larger solution, it does remain an essential component in order to ensure service delivery, availability and continuity. As a consequence, the applications and market players in the downstream sector are driven more by the requirements of end users than by specific technological capabilities or limitations of space systems. As a result, the downstream sector is less homogeneous than the upstream and much more complex to analyse.

While certain service providers have opted for a vertically integrated business model, from ownership of the satellite systems to the provision of services to end users, most would rather procure the required capacity externally.

Satellite operators own satellite infrastructure in order to retail capacity to third parties; this capacity is related to communications (bandwidth), observation (imagery), navigation (positioning) or science (data). These satellite operators procure satellite systems and launch services competitively with the objective of rapidly achieving a high return on investment.

Satellite service providers create value by transforming the advantages of satellite technology into cost-effective services for the users. This segment is highly fragmented with thousands of companies providing a diverse array of services (voice, data, broadcasting, geo-information, etc.) to specific end-user markets including transport, engineering, defence, agriculture, media, tourism, consumers, etc. The actors in this segment vary from multi-national corporations addressing mass markets (such as satellite TV broadcasting) to small companies active in professional niche markets.

Terminal suppliers provide remote end-user equipment such as very-small aperture terminals (VSATs) which send and/or receive signals for a variety of applications including television broadcast, data and mobile communications. As prices have trended sharply lower in recent years, terminal manufacturing has increasingly become a low margin business particularly for fixed applications such as DTH television and consumer broadband. Conversely, terminals for niche markets such as satellite news-gathering and mobility (maritime and aeronautical) applications represent lower volumes but offer higher margins.

2.2 Trends and dynamics in the world space industry

The revenues of the space industry worldwide was estimated at US$250 billion in 2013, which included

- US$204 billion for revenues derived from commercial space activities from upstream (e.g. space systems manufacturing) to downstream (e.g. services) activities.

- US$46 billion in revenues derived from government customers (based on the consideration that on average 70% of government budgets are contracted to industry). This includes industry contracts related to government space activities such as space exploration, space science, launch vehicles, manned spaceflight and government satellite missions (Earth observation, satellite communications, satellite navigations etc.).

Figure 4 provides an overview of global commercial space activities (i.e excluding government activities) by value chain on the left and by application, on the right.

Figure 4: World's industry revenues from space activities in 2013

US$204 billion

12%

(last 5 years CAGR)

| SATCOM | SATNAV | EO | |

|---|---|---|---|

| Revenues from commercial market | 66% | 32% | 2% |

US$46 billion

1%

(last 5 years CAGR)

| SATCOM | SATNAV | Other | Launchers | EO & METEO | Manned spaceflight | Science & exploration | |

|---|---|---|---|---|---|---|---|

| Revenues from government market (includes classified and generic technology programs) |

12% | 7% | 22% | 14% | 17% | 18% | 9% |

Source: Euroconsult

Focus on the satellite manufacturing market

As shown in Figure 5 and 6 below, in the past 10 years government and commercial operators lofted 800 satellites with a launch mass over 50 kg into space. From 2014 to 2023, a further 1,155 satellites are expected to be launched that should generate manufacturing revenues of US$188 billion over the decade, growth of 25% compared to the past 10 years. Of these future satellites, 350 will be commercial (over 80% for communications and broadcasting services), representing a manufacturing market of US$56 billion over the ten year forecast period.

The commercial satellite manufacturing market is global, competitive and price intensive. It currently includes approximately 30 Tier 1 companies in a position to assemble, integrate, and test (AIT) complete satellite systems of different capabilities. Fewer than 10 manufacturers compete internationally for commercial GEO communications satellites with historically the four U.S. and two European manufacturers dominating the market with over 80% of combined market share. In addition, the satellite manufacturing industry depends heavily upon governments that support technology development through direct R&D funds or investment that industry can leverage on the commercial market. National public programs have been essential over the years in order to support innovation and competitiveness of their industry, even in the communications market, often perceived as commercially "mature". This is highlighted in Figure 7 that shows the direct relationship between government funding levels and industry market performance: U.S. industry benefits from the world's largest government satellite communications program and European industry enjoys the world's largest civil R&D program dedicated to satellite communications, which in turn explains the performance of these industries in the international commercial market.

Figure 5: World satellites launched by type of operator (2004-2023)

| Past | Forecast | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Commercial | 13 | 14 | 19 | 23 | 32 | 22 | 24 | 27 | 22 | 24 | 38 | 52 | 55 | 47 | 25 | 33 | 20 | 28 | 25 | 27 |

| Government | 27 | 34 | 38 | 35 | 31 | 34 | 36 | 52 | 42 | 53 | 62 | 70 | 70 | 66 | 68 | 56 | 56 | 51 | 43 | 53 |

| Military | 19 | 14 | 19 | 30 | 16 | 27 | 24 | 22 | 23 | 21 | 21 | 15 | 18 | 24 | 21 | 27 | 21 | 25 | 20 | 18 |

| General total | 59 | 62 | 76 | 88 | 79 | 83 | 84 | 101 | 87 | 98 | 121 | 137 | 143 | 137 | 114 | 116 | 97 | 104 | 88 | 98 |

Source: Euroconsult

Figure 6: World satellites launched by applications

| Telecom | Earth Observation | Navigation | Technology | Security | Science | Meteorology | Exploration | |

|---|---|---|---|---|---|---|---|---|

| 2004-2013 (Total 817 satellites) |

41% | 21% | 11% | 8% | 6% | 6% | 4% | 2% |

| Telecom | Earth Observation | Navigation | Technology | Security | Science | Meteorology | Exploration | |

|---|---|---|---|---|---|---|---|---|

| 2014-2023 (Total 1.155 satellites) |

41% | 29% | 11% | 2% | 4% | 5% | 6% | 2% |

Source: Euroconsult

Figure 7: Government funding and market shares in satellite communications

(2004-2013)

| US + Europe | Other | |

|---|---|---|

| Government funding | 70% | 30% |

| US + Europe | Other | |

|---|---|---|

| Commercial market share (satellite manufacturing) |

88% | 12% |

Source: Euroconsult

Focus on commercial satellite services markets

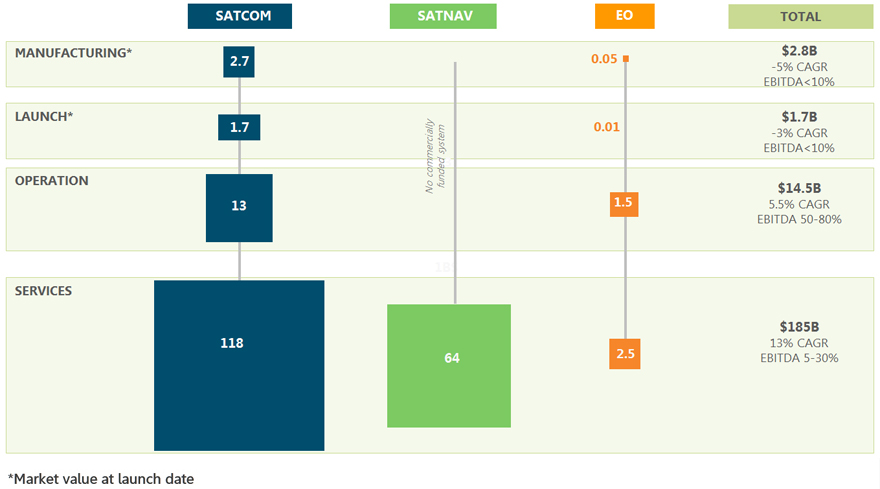

Downstream, three value chains have developed for the provision of commercial services derived from satellite systems: communications (Satcom), Earth observation (EO), and navigation (Satnav).

(US$ in billion)

Figure 8 - Text version

| SATCOM | SATNAV | EO | Total | |

|---|---|---|---|---|

| Manufacturing (market value at launch date) |

2.7 | No commercially funded system | 0.05 | $2.8B -5% CAGR EBITDA<10% |

| Launch (market value at launch date) |

1.7 | No commercially funded system | 0.01 | $1.7B -3% CAGR EBITDA<10% |

| Operation | 13 | No commercially funded system | 1.5 | $14.5B 5.5% CAGR EBITDA 50-80% |

| Services | 118 | 64 | 2.5 | $185B 13% CAGR EBITDA 5-30% |

Source: Euroconsult

As shown in Figure 8, communication services are the most developed commercially as the telecommunications and broadcasting industries have used satellite networks extensively for 45 years. Today they generate over 66% of the value of the commercial market.

- Commercial satellite communications operators generated revenues of US$13 billion in 2013. Fixed Satellite Service (FSS) operators own and operate satellites and lease satellite capacity on a wholesale basis to telecommunications operators, broadcasters, internet service providers, VSAT providers, and other service providers for various communications and broadcasting services. As of 2013, 37 FSS satellite operators are active on a national, regional, or global basis around the world. The market is very concentrated, with the top five FSS operators accounting for 70% of 2013 revenues. Mobile Satellite Service (MSS) operators sell or lease satellite capacity in the form of airtime (minutes) or bandwidth (MHz) on a wholesale basis to customers. Five MSS operators were active as of 2013, with historical operator Inmarsat accounting for 62% of total revenues.

- Satellite communication services are quite diverse by nature and are provided by several hundred individual companies, most notably for DTH broadcasting, consumer broadband, enterprise networks, maritime and aeronautical communications. Total 2013 revenues of satellite communication service providers are estimated at US$118 billion, of which 90% come from video services (essentially DTH TV broadcasting). This sector is experiencing increasing vertical integration (operators acquiring service providers) and consolidation as a way to enhance market share or profit margin in a highly competitive environment.

The satellite navigation service market has experienced considerable growth but features a distinct value chain profile due to its lack of commercial upstream infrastructure ownership.

- As current systems are funded and operated directly by government agencies, there are no commercial revenues associated with the manufacturing of satellite navigation systems. Investment in satellite navigation remains highly concentrated in a few countries as the launch cost of a functional system is extremely high. As of 2014, two countries have operational GNSS systems in place: The U.S. with GPS and Russia with Glonass. Europe and China are developing their own GNSS infrastructure (Galileo and Beidou).

- Satellite navigation value-added services have experienced considerable growth over the last decade, providing a large market for equipment (terminals) and service providers. A forecast released by the European Global Navigation Satellite Systems AgencyFootnote 3 indicates that GNSS devices are planned to increase almost four-fold generating a market from around US$2 billion in 2013 to close to US$7 billion in 2022. In addition, the GNSS services market is estimated to double from US$64 billion in 2013 to US$100 billion in 2022. The personal LBS market (primarily smartphones) and road transportation are the two key drivers for the development of commercial services representing collectively over 90% of the market. Agriculture, surveillance, rail, maritime and air transports share the remaining 10% of market value.

Commercial Earth observation remains an emerging market.

- The commercial data market is valued at US$1.5 billion. The sector is highly concentrated as two companies account for over 50% of commercial data sales: DigitalGlobe and Airbus Defence & Space. Along with MDA, the three companies are the only ones with revenues over US$100 million for EO satellite data and services. Defence remains the key driver (59% of the market) as commercial data has helped to fill the gap for defence solutions.

- Earth observation imagery providers distribute data through data distribution and value-added reseller partners. Distributors may have exclusive rights to certain countries/regions for sale, and/or specialize in providing solutions to certain vertical markets. This creates a very fragmented downstream sector, with value-adding activities occurring at multiple levels, for example by operators and then again by specialized companies/research institutes depending on specific end-user needs. Total revenues within value-added services are estimated at US$2.2-2.5 billion in 2013.

As shown in Table 3, the entire satellite service market is experiencing significant technical and business changes that affect supply and demand dynamics.

| Demand dynamics | Competition dynamics |

|---|---|

| Communications | |

|

|

| Navigation | |

|

|

| Observation | |

|

|

The Canadian space sector

1. Government space activities in Canada

1.1 A new policy framework

In 2012, the Government undertook a comprehensive review of Aerospace and Space Programs and Policies. The findings of this Review, referred to as the Emerson report,Footnote 4 led to the release of a new Space Policy Framework in 2014,Footnote 5 which outlines broad national goals for the space program and the creation of a Space Advisory Board to provide expert advice to government on Canada's role and future in space. The five core principles that will inform Canadian space activities as set out in the Space Policy Framework below provide direction on priorities and areas requiring action. In order to implement the new Space Policy Framework, a new approach of multi-stakeholder governance has been established to improve oversight, monitor progress and provide independent views on space programs managed by the Government of Canada.

Canada's Space Policy Framework

Principles

- Canadian Interests First

- Positioning the Private Sector at the Forefront of Space Activities

- Progress Through Partnerships

- Excellence in Key Capabilities

- Inspiring Canadians

Areas for Action

- Commercialization

- Research and Development

- Exploration of Space

Stewardship, Management & Accountability

Source: CSA

In parallel, other strategic initiatives of the government will influence the direction of space activities in Canada. For instance, in December 2014, the government unveiled an updated Science, Technology and Innovation (ST&I) strategyFootnote 6. This new strategy added advanced manufacturing as a new ST&I priority and included automation with robotics, aerospace and nanotechnology as three of sevenFootnote 7 focus areas within advanced manufacturing that are considered strategically important to Canada. Such objectives support and implement space policy principles such as the development of excellence in key capabilities.

DND and Canadian Armed Forces (CAF) have had a space policy since 1992; more recently, a draft National Defence Space Policy and Strategy has been developedFootnote 8 to support the six core mission areas identified in the Canada First Defence Strategy. That new defence space policy reflects the strategic importance of space to the DND/CAF and emphasizes the requirement for Canada to establish a whole-of-government and comprehensive approach, as well as seeking cooperative opportunities with key allies. In reinforcing the idea that assured access to space capabilities is essential for the CAF to successfully conduct operations, it specifies three overarching objectives:

- Deliver and sustain space effects, such as Command, Control, Communications, Computers, Intelligence, Surveillance and ReconnaissanceFootnote 9

- Integrate space effects

- Assure freedom of space operations

1.2 Key departments involved in space activities

The Minister of Industry is responsible for the design and implementation of Canadian space policy and programs which includes the responsibility for the Canadian Space Agency (CSA), as well as other space related organizations in his portfolio, including the Communications Research Centre (CRC) and National Research Council of Canada (NRC).

The CSA acts as the government's lead agency for space, through collaboration with Other Government Departments (OGDs), private organizations, universities and international partners, and is responsible for assisting the Minister in coordinating all federal space-related policies and programs. To support implementation of the Space Policy, the CSA's immediate priorities will be to continue the implementation of government decisions on flagship missions such as the RADARSAT Constellation Mission (RCM) and the International Space Station (ISS) project, where Canada renewed its commitments until 2020. Alongside flagship missions, the CSA will continue to develop Canadian participation in international missions such as the NASA/CNES Surface Water and Ocean Topography (SWOT) mission. Advancing Canada's space capability through investing in early stage technology development, providing flight opportunities and supporting the development of highly qualified personnel (HQP) in areas key to Canada's future are also important priorities for the CSA in the coming five years. Table 4 provides a description of major space projects currently underway.

DND has played an increasing role in the national space program reflecting the enhanced priority given to national security and sovereignty. Defence programs contribute primarily to the objective of meeting Canada's security needs including surveillance and access to secure communications networks through the combination of national and international assets. This led to the establishment of Canada's Director General Space (DG Space). DND has engaged in an ambitious plan, focused on developing capabilities in communications as well as intelligence, surveillance and reconnaissance (ISR), with emphasis on the Arctic and maritime security.

Natural Resource Canada's Remote Sensing Centre (CCRS) and Canadian Space Weather Forecast Centre receive process and disseminate remotely sensed data for Canada and dispatch space weather forecasts.

OGDs have increasingly become involved in space matters, primarily as users and in some cases service providers, such as Environment Canada and Fisheries and Oceans Canada (as more detailed on p.40).

| Government funding | Program name | Application | Features |

|---|---|---|---|

| >$1 billion | International Space Station | Space Science and Exploration (Civil) |

Canadian contribution to the ISS includes, the Space Station Remote Manipulator System, mobile base and the Dextre system. Following completion of the ISS assembly, participants will now be focused on utilization for scientific experiments. Confirmed commitment until 2020. |

| RADARSAT Constellation Mission (RCM) | Earth observation (Dual) |

An evolution of the RADARSAT Program with the objective of ensuring data continuity, improved operational use of Synthetic Aperture Radar (SAR) and Automatic Identification System (AIS). To be launched in 2018. | |

| $500 million to $1 billion |

Protected Milsatcom | Communications (Defence) |

Protected MILSATCOM is the name for Canadian participation to the U.S. Air Force's Advanced Extremely High Frequency (AEHF) system. Agreement covers a 12-year period, through a partnership with the US, U.K., Canada, and the Netherlands. 3 of 6 satellites launched by 2013. |

| $100 million to $500 million | Mercury Global | Communications (Defence) |

The Mercury Global project is the name given to Canada's participation in the US Wideband Global Satellite Communications System (WGS). DND signed an agreement with the US DoD for 20-year access to the WGS System in exchange of funding one satellite of the constellation (6 satellites launched; 4 more satellites to be launched). |

| Polar Epsilon 2 | Earth observation (Defence) |

DND plans to develop infrastructure to permit collection, processing, exploitation and dissemination of RCM SAR and AIS data. To be completed in 2018. | |

| James Webb Telescope | Space science and exploration (Civil) |

U.S. (NASA) led Successor to the Hubble Space Telescope. Fine Guidance Sensor (FGS) and the Near-InfraRed Imager and Slitless Spectrograph (NIRISS). Slated for launch in 2018. | |

| $50 million to $100 million |

SAPPHIRE | Space security (Defence) |

Launched in 2013, Sapphire monitors space objects orbiting between 6,000 and 40,000 kilometres above the Earth's surface on a 24-hour basis. It is Canada's contribution to the international space surveillance system. |

| OSIRIS-Rex | Space science and exploration (Civil) |

U.S (NASA) led mission to return a sample of asteroid Bennu to Earth. Canadian contribution is an OSIRIS-REx Laser Altimeter (OLA). To be launched in 2016. | |

| CASSIOPE | Space science and exploration (Civil) |

First Canadian hybrid satellite to carry a dual mission in the fields of telecommunications and scientific research, particularly space weather. Launched in 2013. | |

| $10 million to $50 million |

NEOSSAT | Space security (Dual) |

The first world's space telescope to detect and track asteroids, space objects and devris. Launched in 2013 and co-funded by CSA and DRDC. |

| >$10 million | Astro-H | Space science and exploration (civil) |

Japanese (JAXA) led mission to study and explore astrophysical objects, the non-thermal universe, the structure of the universe and its evolution. Canadian contribution is the Canadian Astro-H Metrology System (CAMS). To be launched in 2015. |

| M3MSAT | Communications (Dual) |

Mission objective to demonstrate and further develop a multi-mission capability and allow optimization of the AIS payload in maritime traffic identification. To be launched in 2015. |

1.3 Program orientations reflect a selective funding approach

Canadian government expenditures for space result from combined funding in civil programs and spending commitment from DND in space assets. While OGDs incur expenditures for space, it is a challenge to estimate spending levels where the space-based component is integrated into wider operations. As such information is not available for the purpose of this report, CSA investment constitutes the baseline of civil expenditures. DND funding levels for space activities are not public and have been estimated to represent more or less 50% of Canadian government overall space expenditures in 2013.

In 1999 the Government decided to provide the CSA with a stable A‐base of $300 million dollars per year, leaving flexibility to undertake new activities and address program pressures on an ongoing basis. Over the decade to 2009, the Canadian civil space program benefited from this steady funding base level, after which budgets gradually increased to around $400 million in 2014. This increasing budget is a result of various ad hoc allocations for stimulus initiatives, including that for space robotics, as part of Canada's 2009 Economic Action Plan and also RCM funding allocations since 2010. However, as highlighted in Figure 10, these investments are cyclical and mask the fact that since 2012, the baseline CSA budget has seen a downward trajectory with lower funding allocated to civil space activities outside these targeted increased allocations. These large scale projects have taken over a significant percentage of the CSA's spending leaving little of the flexibility that was conceived of back in 1999 when the $300 million baseline funding was established.

Figure 10: Canada civil space budget

1993-2014 (C$ in million)

| 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CSA baseline | 310.0 | 320.0 | 300.0 | 300.0 | 300.0 | 300.0 | 300.0 | 300.0 | 300.0 | 300.0 | 300.0 | 300.0 | 290.0 | 260.0 | 260.0 | 260.0 | 260.0 | 260.0 | 260.0 | 260.0 | |||||||

| Total spending (incl. ad hoc activities) | 329.0 | 288.8 | 237.5 | 217.9 | 216.1 | 285.6 | 340.0 | 310.0 | 340.0 | 340.0 | 280.0 | 285.0 | 290.0 | 314.5 | 294.7 | 302.7 | 339.7 | 370.0 | 410.0 | 320.0 | 410.0 | 360.0 | 485.0 | 385.0 | 325.0 | 325.0 | 295.0 |

Source: CSA

Funding patterns reflect the niche strategy to concentrate Canada's efforts in a few strategic space technologies. As such, on average over the past five years earth observation has captured 42% of the CSA's funding allocations, followed by science and exploration (26%) and human spaceflight (18%). Technology and satellite communications received more limited allocations, each representing 10% of the CSA's annual budget (see Figure 11). Therefore Canada tends to dedicate a strong portion of its civil investment to science and technology activities, while Earth observation represents the core focus for satellite applications programs. Several countries that used to have a similar profile of investment decided in the recent years to shift or increase their focus into a wider range of application programs to stimulate commercial opportunities to their industries (such as the UK, Germany or Japan).

Figure 11: Canada civil space spending, breakdown by application 2009-2014

| General budget | Telecom | EO | Space Science & Exploration | Technology | Human Spaceflight | Other | |

|---|---|---|---|---|---|---|---|

| Canada civil space spending, breakdown by application 2009-2014 | 16% | 3% | 35% | 21% | 8% | 15% | 2% |

Source: CSA

1.4 Canada position within global government space activities is declining

The two extra, or ad-hoc, funding in the last five years have enabled to maintain Canadian share in the world's global investment. However, as shown in Figure 12, following the RCM funding commitment Canada's share could significantly drop in the world's considering the evolution of CSA's baseline funding.

Since 2013 Canada has not been one of the top 10 countries in terms of investment, with countries such as the U.K., India and Germany investing into their space programs at a higher pace than Canada. When taking into account civil activities only, Canada dedicates today in absolute terms (i.e. in $ value) a funding level comparable to that of Brazil or South Korea. When looking at national investment efforts as a proportion of the national economy (GDP) or per inhabitant, Canada certainly does not lead the pack and lags behind countries having established, or having the ambition to establish, a certain level of global or regional leadership. In addition, and as shown in Figure 13, Canada's space budget-on-GDP ratio is well under the world's average.

Figure 12: Share of Canadian government civil space investment in world's total

2004-2013 (in %)

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|---|---|---|---|---|

| CSA Baseline | 0.90% | 0.91% | 0.92% | 0.90% | 0.86% | 0.70% | 0.77% | 0.77% | 0.76% | 0.62% |

| Total Allocations | 0.86% | 0.88% | 0.97% | 0.88% | 0.86% | 0.79% | 0.95% | 1.05% | 0.84% | 0.98% |

Source: Euroconsult

Figure 13: Budget comparision of Canada with the top world 10 space programs

civil programs only (2013)

| USA | RU | FRA | GER | JP | IT | CAN | IND | UK | CHN | World | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Spending per capita (US$) | 62.462 | 45.348 | 37.957 | 23.069 | 15.368 | 15.001 | 13.444 | 9.434 | 8.768 | 1.000 | 7.289 |

| RU | USA | FRA | IND | GER | CHN | IT | JP | CAN | UK | World | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Spending on GDP (%) | 0.303 | 0.118 | 0.088 | 0.067 | 0.052 | 0.044 | 0.044 | 0.039 | 0.026 | 0.022 | 0.062 |

Source: Euroconsult

2. The space industry in Canada

2.1 Canadian space sector value chain

The Canadian space sector is comprised of over 200 organizations (including 150 private companies and 50 universities) involved at different levels of the space value chain and employing a total of 9,784 workers involved in a wide array of highly qualified jobs. It is estimated that this sector generated cumulative revenues of $5.37 billion in 2013 when taking into account Canadian satellite broadcasting activities, and $2.63 billion when excluding these activities. These cumulative revenues shall not be understood as representing the consolidated economic value of the Canadian space industry which is the objective of the economic impact valuation discussed in the next chapter of this report; it is however an important economic indicator of the commercial activity from the Canadian space sector.

Figure 14 - Text version

The graphic visualization is a series of blocks that represent each segment, with subsequent numbers representing the size of the investment. The Upstream Sector specialized in Space Systems ($825 million), Ground Systems ($135 million), and Research and Engineering ($96 million). The Downstream Sector produced Consumer Services ($2,820 million), Satellite Operations ($1,113 million), and Terminals Systems ($385 million).

Source: CSA, Euroconsult

As shown in Figure 15, in 2013 revenues of the Canadian space industry could be broken down as follows:

- Research and engineering services generated $96 million (1.8% of the total) from 58 companies and 49 universities

- Space systems manufacturing generated $825 million (15.4% of the total) from 35 companies

- Ground systems manufacturing generated $135 million (2.5% of the total) from 16 companies

- Satellite operation generated $1.1 billion (20.7% of the total) from 4 companies

- Terminal suppliers generated $385 million (7.2% of the total) from 16 companies

- Services generated $2.82 billion (52% of the total) from 48 companies; 90% of those revenues were generated by satellite broadcasting activities

No revenues were attributed to launch services as no satellite launch activities take place within Canada.

Figure 15: Three ways to breakdown the Canadian space value chain

| Satellite Operations | Ground Segment | Engineering & Research | Space Systems Manufacturing | Satellite Services | |

|---|---|---|---|---|---|

| By organizations (226) | 2% | 14% | 47% | 16% | 21% |

| Satellite Operations | Ground Segment | Engineering & consulting | Space Systems Manufacturing | Satellite Services | |

|---|---|---|---|---|---|

| By revenues ($5.37B) | 21% | 10% | 2% | 15% | 52% |

| Satellite Operations | Ground Segment | Engineering & Research | Space Systems Manufacturing | Satellite Services | |

|---|---|---|---|---|---|

| By jobs (9784) | 6% | 15% | 14% | 30% | 35% |

Source: CSA, Euroconsult

2.2 Regional footprint of the Canadian space sector

Figure 16 provides a mapping of the Canadian space sector across Canadian regions. Canada's space sector is anchored in Ontario, which accounted for approximately 60% of total revenues and over 55% of employment in 2013. This can be attributed to a strong base of manufacturing, satellite operations and service providers, along with a cluster of universities engaged in space activities. Another hub of space activity is Quebec, which accounted for roughly 20% of revenues and 22% of Canada's space workforce in 2013. Revenues and employment are fairly evenly distributed across other regions, with Alberta leading the way in the Prairies, while Newfoundland and New Brunswick account for the bulk of activities in Atlantic Canada.

Figure 16 - Text version

| B.C | Prairies | Ontario | Quebec | Atlantic | Canada | |

|---|---|---|---|---|---|---|

| Revenues | $320m | $322m | $3.3b | $1.06b | $350m | $5.4 billion |

| Workforce | 468 | 915 | 5560 | 2155 | 685 | 9784 |

Source: CSA Annual Survey (2013), Euroconsult.

2.3 Structure of the Canadian space sector

Key features of the Canadian space value chain include: